Are you thinking about buying a product from Jeff Clark Trader?

I bet you want to make sure he's not a scammer before doing so..

If so this review has your back.

I've looked at hundreds of investing and trading programs and today I'm going to look at all the programs Jeff Clark offers.

This includes Jeff Clark Trader newsletter, Delta Report and Jeff Clark Alliance.

Additionally, you'll see some important insights into Jeff.

Let's get started!

Jeff Clark Trader Summary

Owner: Jeff Clark Trader

Price: $49 per month to $5,698 per month

Rating: 2/5

Do I Recommend? No.

Summary: Jeff Clark Trader isn't someone I would trust with my money.

His high end services are very expensive, there's customer complaints about bad stock picks and nothing in his past can be verified.

Jeff is a typical investing newsletter huckster.

Top Alternative: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

Things To Know About Jeff Clark Trader

Before we get into what Jeff Clark Trader is offering, let's take a look at who the man behind the curtain is.

Here's what I think is most important to know about Jeff Clark:

1) Jeff Is A Product Of Scummy Agora

The reason I started this website is because there's so many scam newsletters out there.

I didn't really see anyone out there giving honest opinions and reviews about them.

Many people either just blindly promote them or ignored all the massive red flags.

But there's many scam artists in this industry trying to sell you products.

There's one company in particular that sells more fraudulent products than all the others.. I'm talking about Agora, the largest financial newsletter company in the world.

There's a good chance if you see a marketing campaign for an investing newsletter it comes from Agora.

They own dozens of publishers and sell hundreds of products... all under different names.

Here's just a handful of their services I've reviewed in the last few months:

- Commodity Supercycles

- Money Map Report

- Nova-X Report

- Mauldin Economics

- Bull And Bust Report

- Palm Beach Letter

- Strategic Investor

And this isn't even all of them.. as you can see I'm very familiar with this company and the kind of stuff they sell.

Agora has some of the most over the top marketing and fear mongering campaigns out there.

And that's not the worst of it.

Recently they were fined millions of dollars by the FTC for selling fraudulent financial and diabetes cures to the elderly.

Additionally, they hire people that have literally been banned from ever trading on behalf of customers by government regulators.

Agora is responsible for a lot of the most hated aspects of the investing newsletter world.

Jeff Clark worked for them for 15 years!

2) Can't Verify Much Of His Past

Jeff Clark makes very grandiose claims in his about me section.

Before becoming a writer for Agora, Jeff says he ran an independent brokerage in San Francisco and managed the money of 100 of California's Wealthiest individuals.

He goes on to claim he's predicted market crashes, got insane returns and broke records with his trades.

Sounds amazing!

The problem? He gives literally zero evidence or proof of this stuff happening.

He doesn't even name the brokerage that he ran in San Francisco.

Think about how many billionaires there are in California.. he says he managed all their money.

You'd have to have a very famous brokerage for that to be possible.

I checked FINRA (the organization you have to register with to sell securities) and there's nothing about a Jeff Clark from San Francisco running a brokerage.

Never believe anything these financial gurus say without actual proof.

I'm not saying Jeff is lying but there's a good chance he is.

I've come across numerous people that lie about their past and lie about their experience investing.

In fact, most of these gurus are lying in some way, shape or form.

Just ask yourself this question..

Why would Jeff "retire" from managing the wealthiest people's money? That would make him a boatload of money.

Also, ask yourself why he would be working for a financial newsletter for 15 years if he was this great investor.

If Jeff truly did have this brokerage my guess is he was getting bad results and had to shut down, like Whitney Tilson did.

3) Jeff Trades Options

Jeff is an option trader and his more expensive services give you option alerts.

There's pros and cons to options.

Here's a breakdown of them:

Pro #1: Lower Financial Commitment

The good thing about options is you don't have to commit to buying a stock right away.

All you're doing is betting that a stock price will go up or down at a certain point.

You don't even have to buy the stocks the day the contract expires.

Pro #2: Can Wait To See How Things Play Out

Some people describe options as putting a stock on layaway and I think that's a pretty good way of describing it.

Basically you're just putting a hold on a stock price to see if you really want to buy it.

If it turns out that you don't want to buy it at the price in the future you just lose the money it cost to buy the contract.

Con #1: Unlimited Risk If You're A Seller

If you buy an option contract you don't actually have to buy any stocks.

However, if you're the option seller (the person who wrote the contract) you do have to buy the stock in your contract.

If you write a bad contract no one will want to buy it and you'll need to buy the stock no matter what, even if it's a bad investment.

Con #2: Short Term Investing

Predicting where a stock will be in a few years is a lot easier than predicting where it will be in a days, weeks or months.

The market is crazy and sometimes unforeseen things can happen.

Options play out in the short term which makes having a sound strategy hard.

Recommended: The Best Place To Get High Return Stock Ideas

Jeff Clark Trader Product Overview

Jeff Clark offers 3 different premium services.

Here's a look at each one.

Jeff Clark Trader ($199 Per Year)

This is the flagship product offered by Jeff and is the introductory service for him.

You get the following with this subscriptions:

- Year Of Newsletter: You get 12 issues of Jeff Clark Trader and receive a new copy on the 4th Monday of every month. In this report you'll get market analysis and a new trade idea.

- Updates: You'll sometimes need to take action before you get your monthly issue of the newsletter. This is where the updates come in. If there's an update on any stock in the portfolio you'll get an alert. If there's a good opportunity to buy a stock you'll get an alert as well.

- 3 Stock Retirement Blueprint: This is a blueprint of 3 stocks that you can buy now and not worry about them. This is a complete breakdown of why the stocks were chosen and how to trade them.

- Options Video Series: This is an educational program that teaches Jeff's option trading strategy.

The Delta Report ($5000 A Year)

The Delta Report is an options alert service that claims you can make triple digit returns every month.

Maybe there's a few months you can get triple digit months but you're certainly not doing that every month - that's a complete fantasy.

Here's a breakdown of what you get:

- 1 Year Of Alerts: Every Tuesday morning you'll get an email detailing an option trade you can make.

- Special Report: This special report details how to make money in a bear market.

- Daily alerts: Besides the weekly alerts you also get daily alerts. If a position needs to be added or if you need to lock in gains, you'll get an alert to do so

- Option Training: You'll receive an 8 part option trading tutorial that covers Jeff's strategy.

- Delta Direct: This is an app that allows you to track all trades that Jeff makes.

Jeff Clark Alliance ($5,698 For Lifetime)

The last option is to buy a lifetime membership to Jeff Clark Alliance.

This will cost $5,698 and there's a yearly $199 charge.

With this subscription you get access to Jeff Clark Trader newsletter, The Delta Report and access to any new programs Jeff launches in the future.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

Jeff Clark Trader FAQ's

Here's some answers to any remaining questions you might have:

1) Is Jeff Clark Trader's Prices Fair?

The Jeff Clark Trader newsletter isn't terribly priced and you can find it with a 50% discount.. meaning it will cost $99 per year instead of $199 per year.

But these programs are usually designed to make you buy the more expensive services.

I don't think Delta Report is worth $5,000 a year.

The reviews for this product are absolutely horrible which I'll cover shorty.

The Jeff Clark Alliance is very expensive as well, although, it makes more sense to get this service than the Delta Report, since the Delta Report is included in Jeff Clark Alliance.

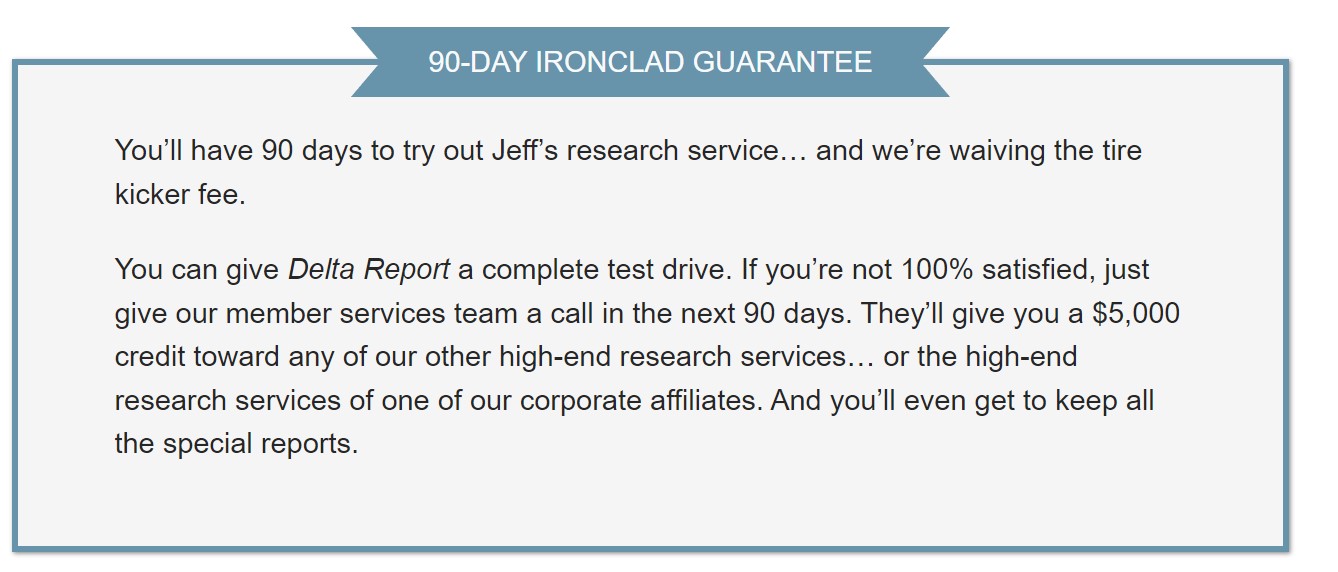

2) Is There A Refund Policy?

There's apparently a 60 day money back guarantee with Jeff Clark Trader newsletter.

However, there's an EXTREMELY misleading refund policy with the more expensive products.

I think a lot of people see the phrase "90 Day Ironclad Guarantee" and assume this means you can get your money back.

But that's not the case.

You only get a credit that you can use towards other products.

Well The Delta Report is the most expensive product Jeff offers.. this means you'll have to put the credit towards one of their "corporate affiliates."

This means other overpriced, garbage products from Agora.

A guarantee like this screams greed to me.

3) How Much Do I Need To Trade?

You need $5,000 to $10,000 usually to trade options.

There's certain regulations that require $1,000 to $2,000 to start bare minimum option trading but you need much more to be able to trade what you want.

$10,000 will get that for you.

But if you actually want good results you need even more to trade options.

I would say $25,000 is a good number.

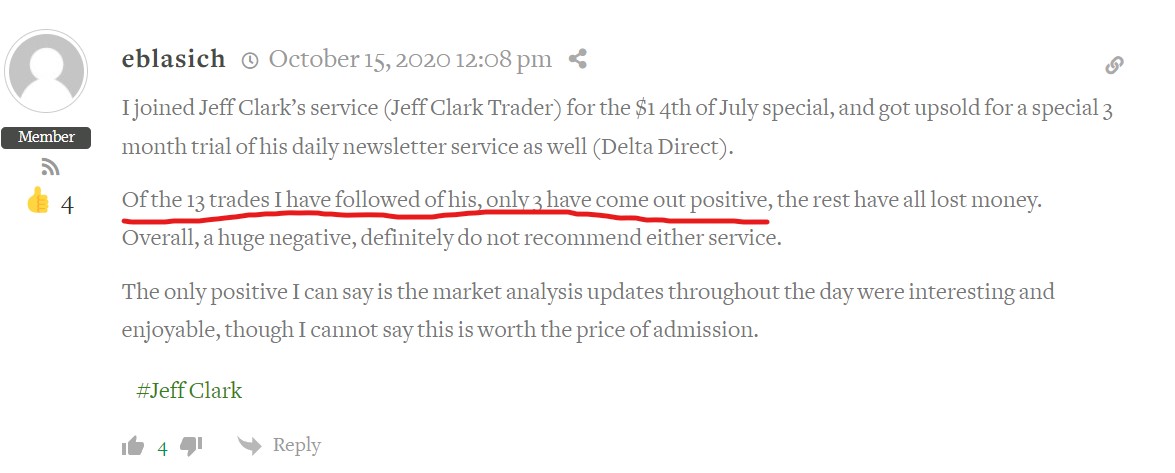

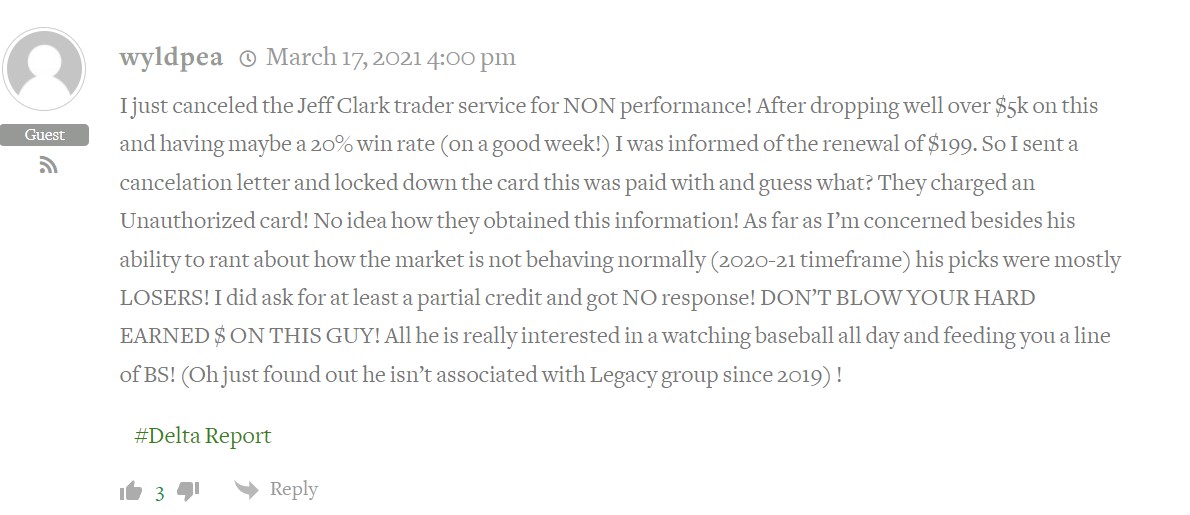

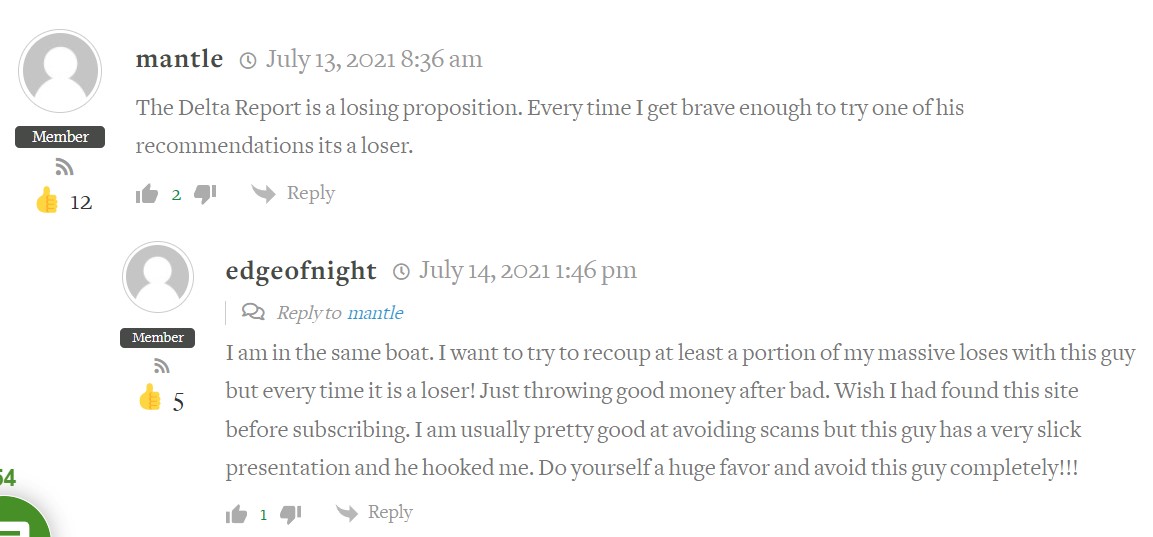

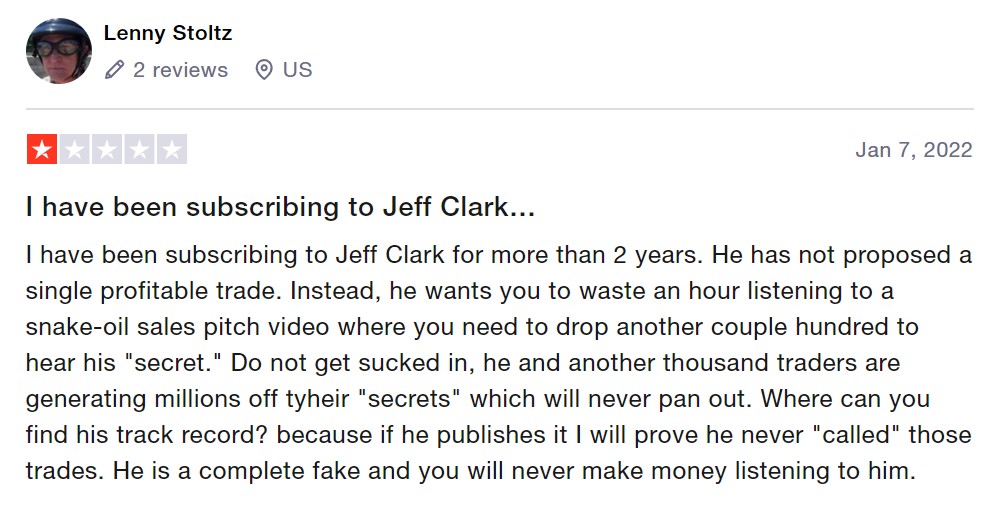

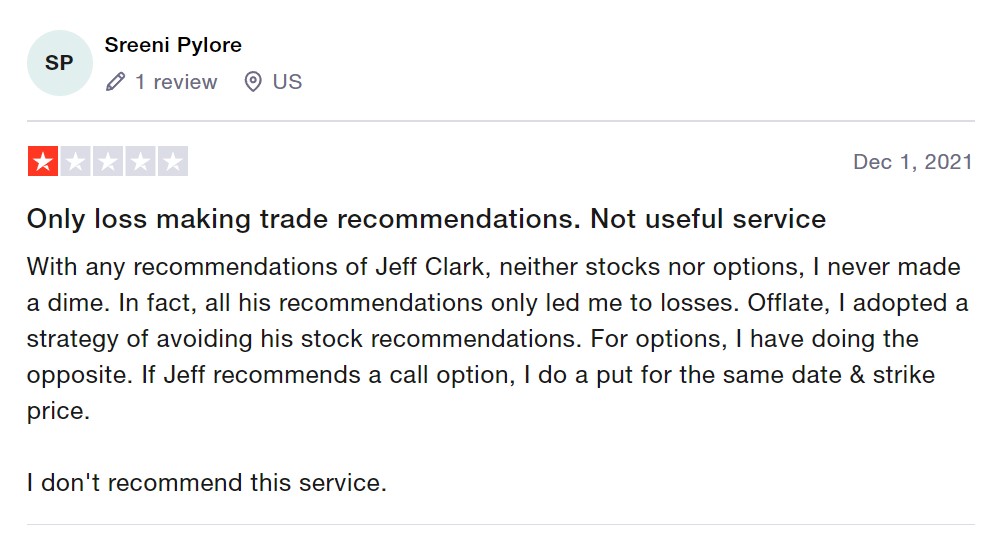

4) Jeff Clark Trader Common Customer Complaints

Jeff Clark Trader is NOT well reviewed by customers.

The biggest complaint is people are losing money.

Here's a bunch of people complaining about this:

At the end of the day these services can't deliver winning trade ideas.

Recommended: The Best Place To Get High Return Stock Ideas

Jeff Clark Trader Pros And Cons

Jeff Clark Trader Conclusion

Jeff Clark is not someone I would trust.

He makes huge claims about his past but offers zero evidence to back anything up.

Jeff says he ran a successful brokerage that managed the richest people's money.. but never stated name of the brokerage.

I looked through government resources and couldn't find a Jeff Clark that ran a brokerage in San Francisco, like he claims.

Maybe I'm missing something, maybe I'm not.

But why not mention the brokerage? Why not let people investigate your claims?

Either this brokerage never existed or he's hiding something.. like the returns were bad and he had to close down shop because of that.

Other than that he's been working for Agora for over 15 years.

Agora produces scam after scam.

There's too many customer complaining about the results too.

I'd avoid.

Here's A Better Opportunity

I'd pass on Jeff Clark Trader.. I personally would trust him with my money.

The good news is there's plenty of investing newsletters out there that are worth it.

To see my favorite (which is affordable to try), click below:

Get High Return Stock Ideas!

See where I get my winning stock ideas below: