Strategic Investor is an investment letter from David Forest.

It mostly focuses on gold, commodities and crypto.

You may have some questions about this product like "is Strategic Investor a scam" or "is it worth its price."

This review will answer those questions and more.

So take a few minutes and read everything below.. you'll know if Strategic Investor is right for you by the time you're done reading.

Let's get into it!

Strategic Investor Summary

Owner: David Forest

Price: $199

Rating: 2/5

Do I Recommend? No

Summary: There's a lot more not to like about this newsletter than to like.

The picks aren't good and many lose money.. also there's a lot of customer complaints about getting overcharged and random charges on their credit cards.

I'd avoid.

Top Alternative: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

3 Facts About Strategic Investor

Before we get into what Strategic Investor has to offer, let's take a look at some important background information about this newsletter.

Here's what I think you should know:

1) David Forest Runs Strategic Investor

David Forest is the creator of this newsletter.

To be completely honest there's really not too much out there about him.

The only thing I could really find was stuff he wrote about himself or from other places that were clearly being paid to promote Strategic Investor.

The only thing I can find is that David was a geologist and a commodity speculator.

He focused on mining, oil and gas.

Eventually he started working for Casey Research in 2004 and tookover this newsletter.

Additionally, he still coordinates mining products in different parts of the world.

Kind of weird there's nothing really out there about him, though.

You'd expect some interviews or some stories but I couldn't find anything.

2) Casey Research Publishes The Newsletter

Casey Research is the publisher of Strategic Investor.

This company is owned by Dave Casey.

Doug Casey is someone that's been around for a long time and is pretty well known.

For instance, his book Crisis Investing was on NYT Best Seller list for 29 weeks all the way back in 1980.

Dave is a hardcore libertarian who describes himself as an anarcho-capitalist.

He believes in an extremely limited government to the point of no government.. where everything is privatized including the police and courts.

His specialty is in gold, metals and other commodities.

So if you're a lover of people like Ron Paul, Ayn Rand and libertarianism you'll enjoy Dave's and Casey Report's insights.

3) Agora And The Scoundrel Teeka Tiwari

Agora Financial owns a lot of the financial products on the market.

I knew the second I went on to the Casey Report website we were dealing with an Agora owned company.

Agora is the biggest distributor of investing newsletters and they sell other products as well (like health products).

This is not a company with a good reputation.

For instance, just last year they were fined $2 million by the FTC for defrauding senior citizens.

They were selling old people phony diabetes cures and scam financial products.

I mean, does it get any lower than that?

Unfortunately it does..

One of the worst scoundrels in the investing world is featured all over Casey Report's websites with links to his webinar.

The scoundrel I'm talking about is Teeka Tiwari.

Teeka Tiwari runs another investing newsletter owned by Agora and I guess Agora uses Casey Report's to cross promote Teeka.

Teeka has more red flags than any other person I have come across in the investing world.

He's literally banned from being a broker or working at a brokerage by the government!

It's not good to be associated with this guy and his posts are all over Casey Report's website.

Don't even read anything with Teeka's name on it.

Recommended: The Best Place To Get High Return Stock Ideas

Tracking David Forest's Picks

David doesn't have a place where you can look at all of his stock picks.

However, he does put out teasers for stock picks a few times a year.

These teasers are marketing pitches he uses to sell Strategic Investor.

Basically, he puts out a presentation about a "secret stock" and if you buy Strategic Investor you get access to the stock picks.

These teasers change from time to time and right now the teaser pick is for a "$3.1 trillion "Bitcoin Key" and "Bitcoin's Underground Supplier."

This new teaser came out a couple weeks ago and the stock picks are Intel and STMicroelectronics.

Both picks are down since releasing the teaser but it really hasn't been enough time for them to play out.

However, it has been enough time for Strategic Investor's last two teaser picks to play out.

Let's take a look at their performances:

5G Master Key

Back in June 2021 this was the teaser for Strategic Investor.

Dave was hyping a company that would "fix 5G's flaws."

This stock turned out to be Gilat Satellite Networks (GILT).

This company is a satellite tech company that allows "broadband speed satellite communication."

Basically what they're offering is antennas for 5G towers instead of running fiber optic cables.. the benefit being that it's much easier to maintain and cheaper to install.

This company was actually pitched by Strategic Investor in 2020 when it was run E.B. Tucker.

The stock hasn't done that well since the teaser launched (red arrow indicates when the pitch went live):

Over the last 5 years this stock has been very stagnant besides the brief spike it had in 2021.

#1 Copper Investment In America

This pitch was made in August 2020 by the last editor, E.B. Tucker.

This report is still part of Strategic Investor so I'm adding it.

The copper pitch isn't for a stock and instead is in a royalty investment.

The company being teased is EMX Royalty (EMX).

The big problem with this company is you can't really expect to cash in from it for a while.

EMX Royalty currently doesn't generate any money from copper and just has early stage copper projects in its portfolio.

Most of the money being made by this company is from gold and zinc.

Additionally, there's no real large projects on the horizon for EMX either.

This would be an investment you make now and hope it pays 5 to 10 years down the road.

Recommended: The Best Place To Get High Return Stock Ideas

Strategic Investor Overview

There's a few different components to Strategic Investor.

Here's a summary of everything you get:

One Year Membership To Strategic Investor

This is the main part of the entire offer.

If you sign up you get 12 yearly issues of the Strategic Investor.

In these newsletters you will be getting at least one investment idea per month. A lot of these picks will have to do with commodities.

Also, you get access to the entire portfolio and you can look at pass reports on the member's website

Buy And Sell Alerts

The markets are always moving and big news can effect Strategic Investor's portfolio at any time.

Sometimes you'll need to know something before the monthly issues goes out.

This is where the buy and sell alerts come in.

You'll get updates on the market and any news that effects the portfolio.

Gold Spike Action Plan

This report covers investment strategies in gold.

Dave believes gold is going to enter a bull market and prices will rise for years to come.

He believes this is going happen because prices and inflation are up.

This report will guide you through this upcoming bull market David is predicting.

The Warrant Play Set To Triple Or More

This report covers an investment called warrants.

A warrant is a lot like an option.. but instead of a contract being created between traders, a contract is created between an investor and a company.

You create a warrant to buy a stock at a certain price in the future.. this allows you to gain more stocks at a cheaper price if the company increases in value.

The company being teased in this report is called Canoo, which is an electric vehicle manufacturer.

Things are not going well for Canoo right now and the stock is losing value every month.. it lost 35% value in December 2021 and lost 40% value for the whole year.

Here's a look at the stock's performance over the last 5 years:

Not great!

Warrant Video Course

Lastly, you get access to the warrant video course.

This program comes with 5 videos and it breaks down warrant investments more thoroughly.

You will learn how to find these investments and hopefully find some that will make you a lot of money.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

My Thoughts On Strategic Investor

There's a lot to unpack with this newsletter.

Here's my main thoughts about it:

The Special Report Picks Aren't Good

The teaser picks are supposed to be your very best picks.. they're the ones that get researched the most and the ones you're using to get people to buy.

However, after going through all of these specially researched picks none of them have played out well.

Gilat is down since David started pitching it and it's a stock that hasn't really moved a lot in the last 5 years.

The copper company isn't really doing anything related to copper at the moment.

The special report for the warrant picks is doing AWFUL.

If you invested in Canoo in early 2021 you would have lost 40% on your investment!

Yikes.

Keep in mind these picks come with their own little ebook with all the details of the company and why it's so great.

It's definitely a bad sign that none of these picks have been profitable.

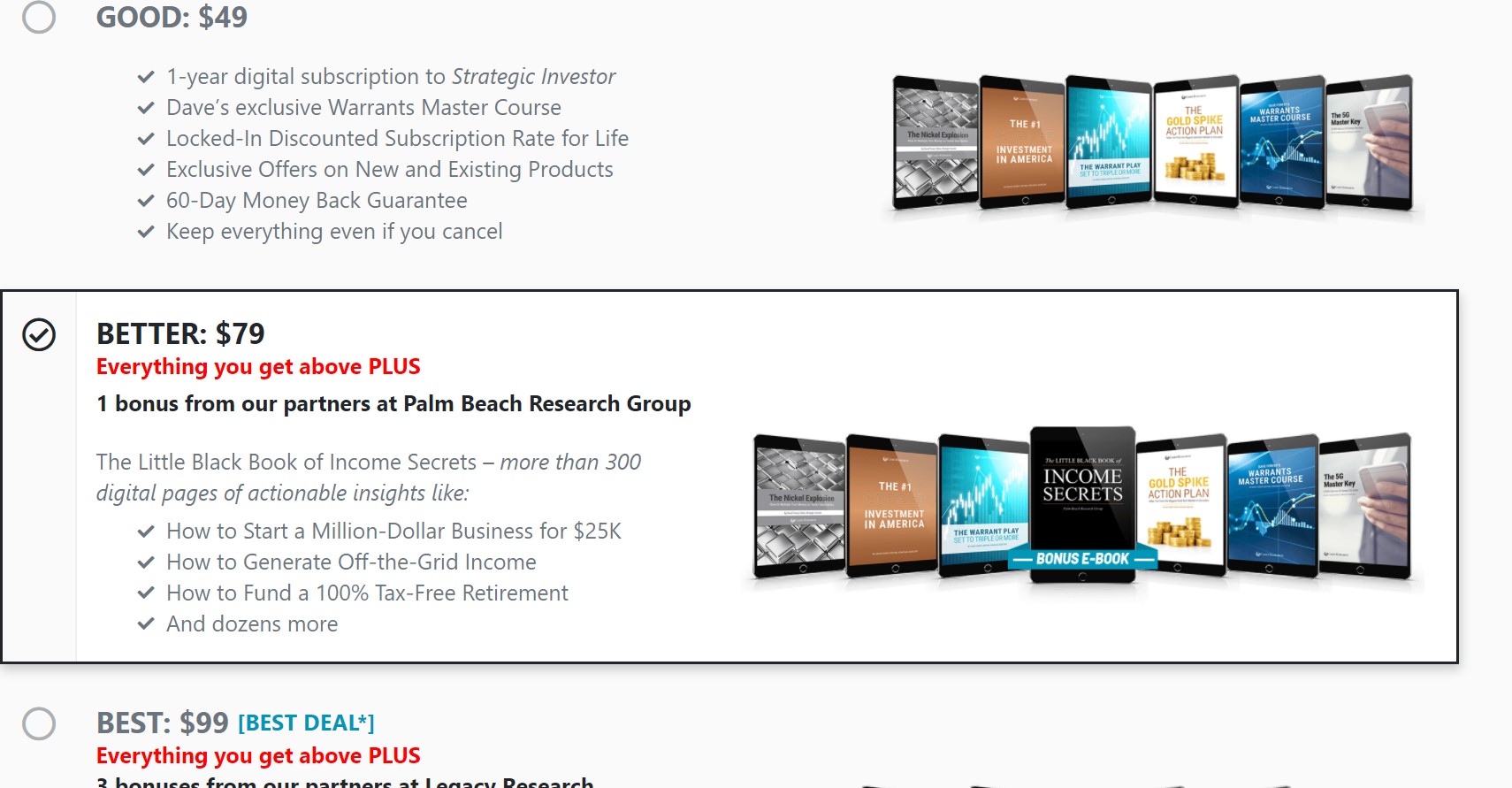

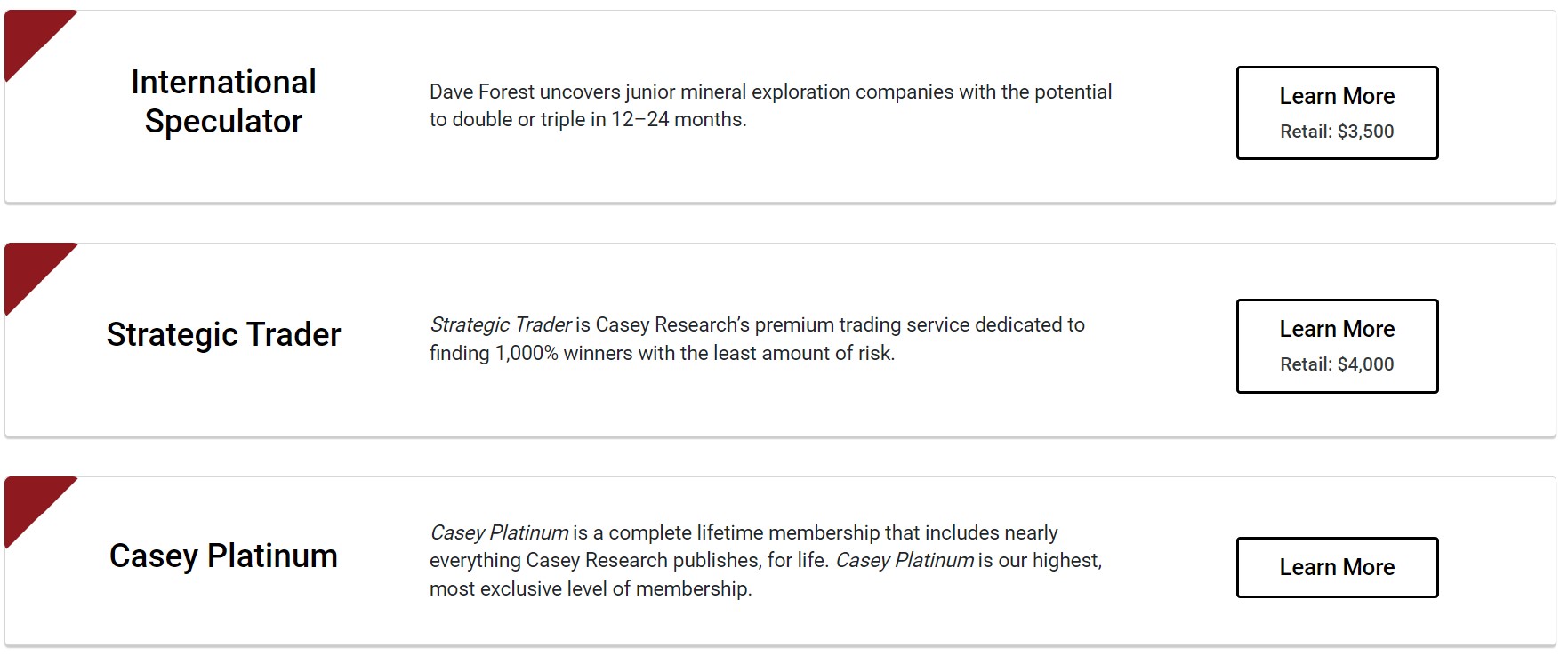

The Price Isn't Terrible.. But There's Upsells

Strategic Investor is $199 for the year which isn't horrible.

Also, if you watch the special presentations that are floating around you get the first year at a very discounted price:

HOWEVER..

There's a reason this product is so cheap.. it's just the first product in a large marketing funnel.

We're talking about a newsletter owned by Agora.. these people are the upsell kings.

Once you buy Strategic Investor you will be constantly bombarded with new offers for much more expensive programs.

These are just some of the products at Casey Report you'll be pressured to buy:

As you can see these products are much more expensive.

You'll also get pitched on other Agora products as well. Some of them will cost tens of thousands of dollars.

You will bombarded every single day with new offers and it's going to get very annoying.

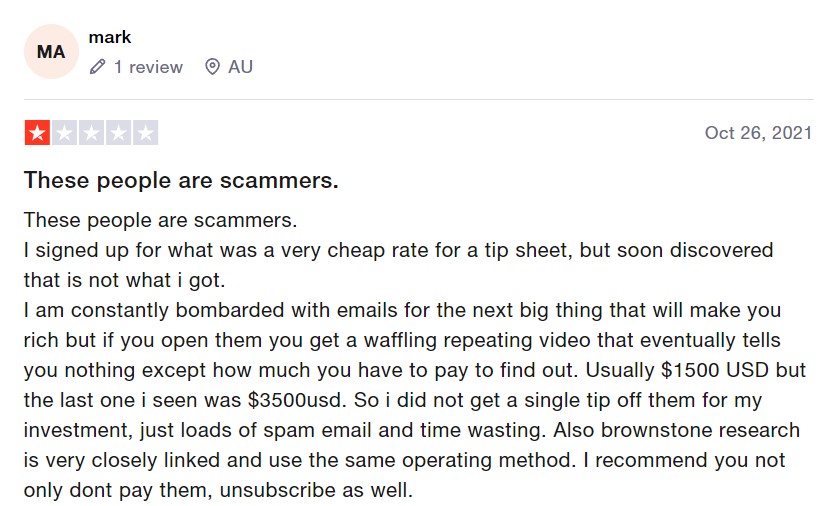

Here's a customer complaining about this very thing:

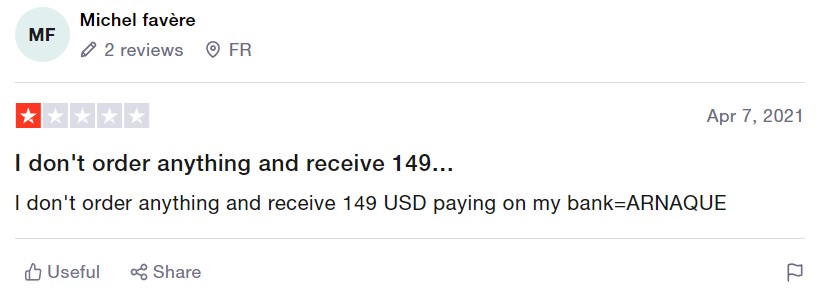

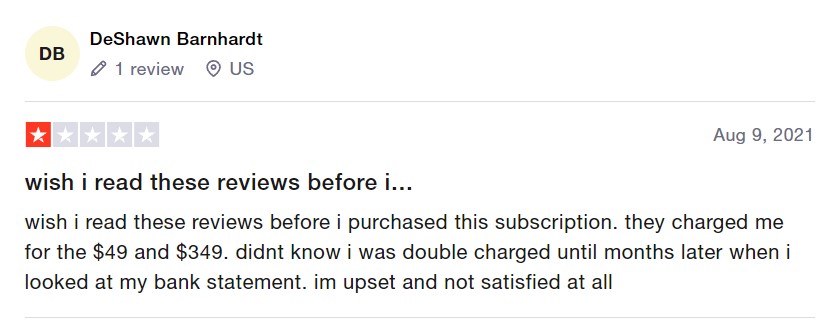

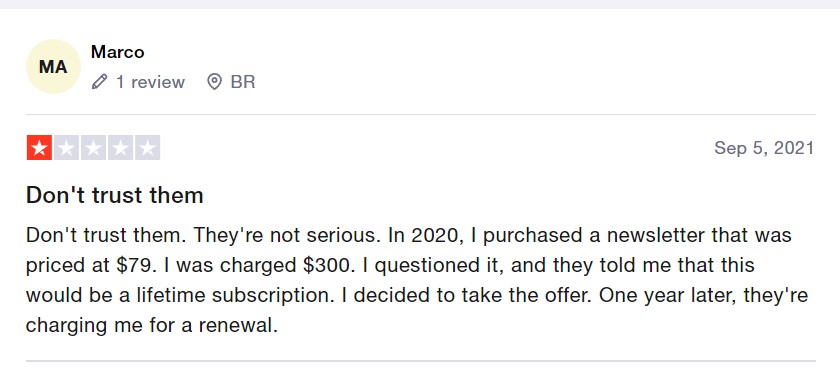

A Lot Of People Upset About Charges

This is another thing that I've found with Agora in the past.. people complain they get random charges on their credit cards after buying.

This seems to confuse a lot of people.

Here's a bunch of people complaining about this:

A lot of this is probably just people not reading the fine print when they buy but there definitely could be some nefarious stuff going on.

We're talking about a company that sold bogus diabetes cures and defrauded the elderly out of their money.

I wouldn't put anything past them.

Refund Policy Is Confusing

I found three different refunds policies for Strategic Investor.

This is the first one I found:

This is a really bad refund policy because you don't get your money back.. you just get credits to buy other products at Casey Research.

The problem with this is Strategic Investor is the cheapest product at Casey Research. All the other products cost thousands.

So you can only get your money back to essentially spends thousands more.

The second refund is the following:

So this one is for 60 days and doesn't say if it's a cash refund or just a credit refund.

The third one I found in the terms of use.

This one says 30 days!

So we have a refund policy of 90 days, 60 days and 30 days.

What a mess.

Recommended: The Best Place To Get High Return Stock Ideas

Strategic Investor Pros And Cons

Strategic Investor Conclusion

I really wanted to like Strategic Investor.

I like a lot of libertarian stances on issues and the owner of Casey Research is a big time (and pretty influential) libertarian.

But I was pretty disappointed in this newsletter as a whole.

There's just to many red flags to ignore.

The second I learned this company was owned by Agora I knew there would be issues.. it's guaranteed.

I knew there would be random charges on people's credit cards and I knew there would be a million upsells.

Both of those turned out true because every Agora product suffers from these issues.

But most importantly the picks just don't seem to be hitting right now.

If there was just one bad pick I'd just chalk that up as part of the investment game.

But every single special report pick is doing poorly and that's a big problem.

I can't recommend Strategic Investor for these reasons.

Here's A Better Opportunity

I'd pass on Strategic Investor.

The good news is there's plenty of other investing newsletters out there to pick from.

I've reviewed all the best..

To see my favorite place to get high return stock ideas (that's affordable), click below:

Get High Return Stock Ideas!

See where I get my winning stock ideas below: