Commodity Supercycles is an investment letter from Bill Shaw.. it focuses on all things commodities like mining companies, energy and natural resources.

Bill claims you can make a lot of money if you sign up.

Before getting too excited I'm sure you want to know if this newsletter is a scam or not.

Congrats on taking the time to research this product before buying.

You'll be rewarded in this review and you'll know if this service is worth it by the time you're done reading.

You'll also see some important background information, an overview of what you get and a look at the price.

Let's get into it!

Commodity Supercycles Summary

Owner: Bill Shaw

Price: $49 to $79 for first year, $199 per year after

Rating: 2.5/5

Do I Recommend? Not really

Summary: Commodity Supercycles is a decent investing newsletter that focuses on natural resources and commodities.

There's some good picks here but there's also some bad ones too.

At the end of the day there's better investing newsletters out there.

Top Alternative: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

3 Facts About Commodity Supercycles

Before we get into what the Commodity Supercycles newsletter is, let's take a look at some important background information.

Here's what I think is most important about this product:

1) Stansberry And Awful Agora

The publisher of Commodity Supercycles is Stansberry and Stansberry is owned by Agora.

I pretty much always recommend staying away from anything that comes from Agora.

They are the largest distributor of financial newsletters and they own dozens of publishers and sell hundreds of investing products.

You might think this is a good thing but it's not.

Agora has a seriously bad reputation and just recently had to pay a $2 million dollar fine for ripping of elderly people.

Stansberry doesn't have a better reputation either.

I actually agree with the owner of Stansberry, Porter Stansberry, on a lot of issues too. He's a libertarian who does a lot of work with my favorite politician of all time, Ron Paul.

But Porter is definitely an alarmist and he uses fear to sell his products - you'll see a lot of this with all Stansberry products.

Stansberry has been fined millions in the past for some of their marketing material.

Essentially it was proven Porter made up stock news to sell newsletters.

So yeah.. we're not dealing with the most ethical people here.

2) There's Not Much Out There About Bill Shaw

There's really not too much out there about Bill Shaw.

The only thing I could find was his bio on Stansberry but I wouldn't just blindly believe what's written there.

I review these investing products for a living and let me tell you something.. almost every person I come across is misleading in some way.

Some people just straight but lie about their past.

He claims to be an expert in commodities and spent 10 years in land development.

Additionally, he's the editor of Stanberry Gold And Silver Investor.

3) Stock Picks Have Been Mixed

Commodity Supercycles is constantly running teaser campaigns for stock picks.

These campaigns are meant to get you to buy the newsletter and you get the stock picks after you do.

They're supposed to be the best picks.

Let's take a look at how some of them have performed in the past.

Sandstorm In March 2022 And October 2019

The most recent teaser campaign revolves around a company called Sandstorm, which is a gold royalty company.

It's being marketed as Stansberry's "#1 Gold Play for 2022."

This is actually the second time this stock has been teased.

In October 2019 it was pitched as the #1 gold play for 2019.

Here's how the stock as performed over the years:

The stock is up and down.. but overall it's up right now.

It did double at one point a short period after it was recommended.

A lot of people like this company and it's meant for long term investing.

So far I think this stock has performed decently well.

Nova Royalty In August 2021

In August 2021 Commodity Supercycles started running a campaign claiming Elon Musk had a big problem and this "Super Charged Battery Royalties" company would solve the problem.

The company being pitched is Nova Royalty, which focuses on copper and nickel.

Here's how the stock has performed so far:

The Stock has been up and down since August.

There's still time for this one to pay out but nothing major so far.

Tudor Jones in July 2020

On July 2020 Commodity Supercycles started running a campaigns called "Two Gold Billionaires Are Investing Heavily In A Small $3 Junior Gold Mining Stock."

The company pitched here is Tudor Gold and at the time just got a large investment from Eric Sprott.

Here's how the stock has performed since:

Shortly after the stock was introduced it shot up a decent amount.

However, these stocks are supposed to be held a couple years.

Since the teaser started running it's down overall.

Recommended: The Best Place To Get High Return Stock Ideas

Commodity Supercycles Overview

You get a fair amount with this newsletter.

Here's a look at everything you receive once you become a member of Commodity Supercycles.

12 Issues Of Commodity Supercycles

This is the core part of the issue and the main thing you're paying for.

The Commodity Supercycles newsletter gets sent out once a month and comes with a new stock pick.

Along with the stock pick you'll get insights into the market and you'll get updates on the portfolio.

Additionally, you'll get emails periodically if a position has changed and you need to sell.

Model Portfolio

You don't just get a stock pick every month.. you also get access to the entire portfolio once you sign up.

There's anywhere from 15 to 25 stocks in the portfolio at all times.

So you'll have plenty to invest in the second you sign up.

Special Reports

The special reports are the teaser stocks we covered in the last section.

There's three or so stocks they'll be pitching in marketing campaigns. Once you sign up you get access to these special reports that reveal what the stock is.

Currently there's three special reports (this could change by the time you read this) and they are:

- Super-Charged Battery Royalties - This is the stock that apparently solves Elon Musk's big problem. It's a nickel and copper company called Nova Royalty. It's pretty much at break even since this special report was launched.

- #1 Gold Play Of 2022 - We already covered this stock as well and it's Sandstorm. This is a company I know a lot of people like and has performed well since 2019, when Commodity Supercycles first started pitching it.

- The Secret Currency - The last special report claims to teach you the secret gold strategy that the wealthiest families in the world use.

Premium Content

You have the option of getting the premium package of Commodity Supercycles.

You get a bunch of reports with the premium subscription but the main part is access to a year of Stansberry Investment Advisory.

Stansberry Investment Advisory is the original investing newsletter from Stansberry and you get a new issue once a month.

This newsletter is run by Porter Stansberry himself.

You can argue Porter's ethics but Investment Advisory actually gets pretty good reviews.

Also, if you buy Investment Advisory separate it costs $199 per year.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

Commodity Supercycles FAQ's

You might still have some questions about this service.

Here's answer to any remaining questions you might have:

1) Is The Price Of Commodity Supercycles Fair?

There's a couple different prices for Commodity Supercycles.

If you try buying from the Stansberry website it will cost you $199 per year.

However, there's promos going around that come heavily discounted.

You can either pay $49 for a year for the regular subscription or you can pay $79 for the premium edition that comes with Stansberry Investment Advisory.

Then it's $199 per year after.

Obviously the promo prices are much better and either are a good deal in my opinion if you want to try it out.

If you can't find a promo I'd just give them a call and see if you can buy it that way.

2) Is There A Refund Policy?

The refund policy is decent.

You get 30 days to get your money back.

You do have to call Agora's customer service, though.

They're notoriously horrible at customer service and I wouldn't be surprised if they try some shenanigans if you do try get your money back.

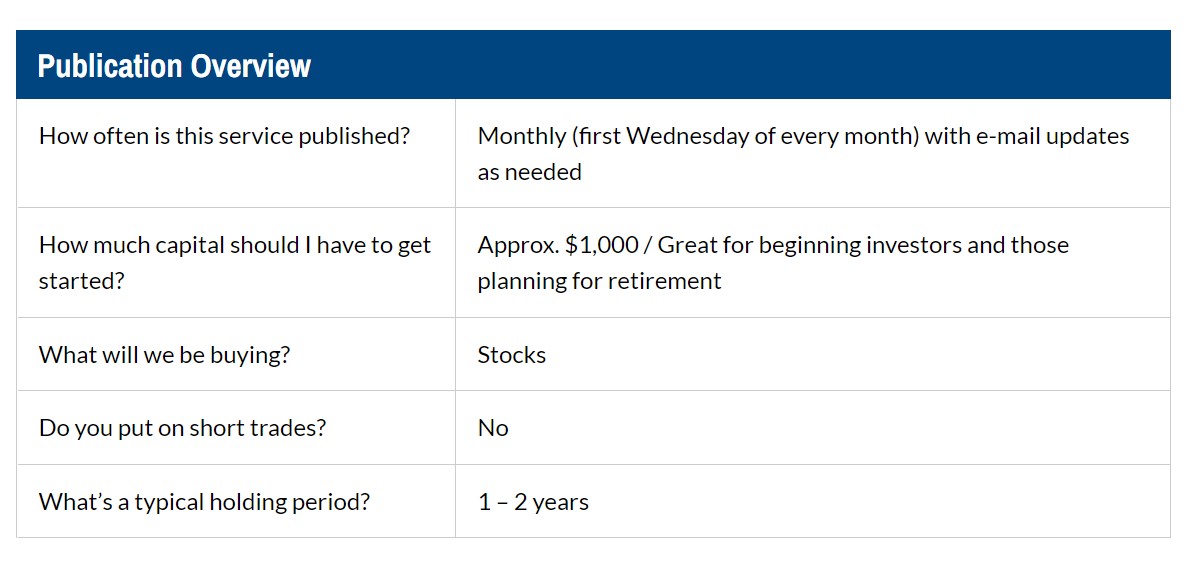

3) How Much Do I Need To Invest?

According to the chart above it's advised you have at least $1,000 to get started.

I personally think you need much more than that.

$1,000 is what you want to spend on each stock pick.

Remember the second you sign up you're going to get a bunch of special reports that will require $1,000 each.

On top of that you'll have a portfolio of up to 25 stocks to choose from as well.

You might not invest in all of them but you'll probably want to invest in a few.

Additionally, you'll be getting stock picks every single month which require more money to invest with.

I'd say $25,000 is a good place to start if you want to buy this newsletter.

4) What are the pros and cons of commodity trading?

There's definitely pros and cons of investing in commodities.

Here's some main benefits and disadvantages:

Protection Against Inflation

Right now we're going through record inflation and investing in commodities is a good way to hedge against that.

Stocks and bonds may suffer in times like this but not commodities.

Rising prices means the cost of commodities rise too.

Good Bet Against Geopolitical Events

As I'm writing this the Russia/Ukraine conflict is raging and supply chain issues are a major problem.

Resources can be scarce in times like this and this will lead to the rise in the cost of commodities.

Again, maybe not the best time for stocks but commodities do well in these uncertain times.

Lower Returns

Commodities typically won't get you the returns you'd see with stocks and just putting your money in an index fund.

Between the years of 1991 to 2017 commodities saw an average return of 2.18%.

In the same time the S&P 500 increased 9.93%.

The volatility was essentially the same for both as well.

Recommended: The Best Place To Get High Returns Stock Ideas

Commodity Supercycles Pros And Cons

Commodity Supercycles Conclusion

This isn't the worst investing newsletter out there.. trust me there's some pretty bad ones.

It reminds me a lot of Strategic Investor and Katusa Research. Both of those are newsletters that are decent but I wouldn't really recommend.

That's how I feel about Commodity Supercycles.

It's alright but nothing special.

There's going to be some good stock picks and some bad ones.

The best part about this offer is that you can get a free subscription to Stansberry Investment Advisory.

While I think the company has some issues and Porter Stansberry has some red flags in his past, this newsletter is pretty well reviewed.

It may be worth getting Commodity Supercycles through a promo just to check out Investment Advisory.

Here's A Better Opportunity

I'd pass on Commodity Supercycles.

I think it's a decent newsletter but there's definitely better out there.

To see my favorite place to get high returns stock ideas (that's very affordable), click below:

Get High Return Stock Ideas!

See where I get my winning stock ideas below: