Cabot Wealth Network has been around for a long time and has a bunch of different products for sale.

Before dropping some money on them I'm sure you want to know if they're scams or not.

Well you're in luck..

You'll get an answer to that question in this review.

Additionally, you'll get answers to more common questions as well.

You'll be a Cabot Wealth Network expert by the time you're done reading.

Let's get started!

Cabot Wealth Network Summary

Owner: Timothy Lutts

Price: Varies (multiple products)

Rating: 4/5

Do I Recommend? I do recommend some products

Summary: Cabot Wealth Network offers some of the longest running investment newsletters around.

They've proven they're trustworthy over the last 50 years and they offer good stock ideas.

The price isn't bad either.

They definitely have products worth considering.

Top Alternative: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

6 Facts About Cabot Wealth Network

There's a lot to know about this investing company.

Here's some of the most important facts about Cabot Wealth Network:

1) Has Been In Business For Over 50 Years!

The investing world is full of newcomers who disappear after a few years of fleecing the public.

Every week a new trading guru pops up and promises fast money and high returns.

Here's an example of one of these scoundrels.

However, Cabot Wealth Network isn't like these newer programs.. they've been in business since 1970.

That's 50 years of reputation and trust building.

Cabot was started by Carlton Lutts Jr.

He has since passed away and now the company is now run by his son, Timothy.

2) Mike Cintolo Is Chief Analyst

Mike Cintolo has been with Cabot Wealth Network for more than 10 years and is the chief analyst.

He's a respected trader that has racked up some impressive accolades.

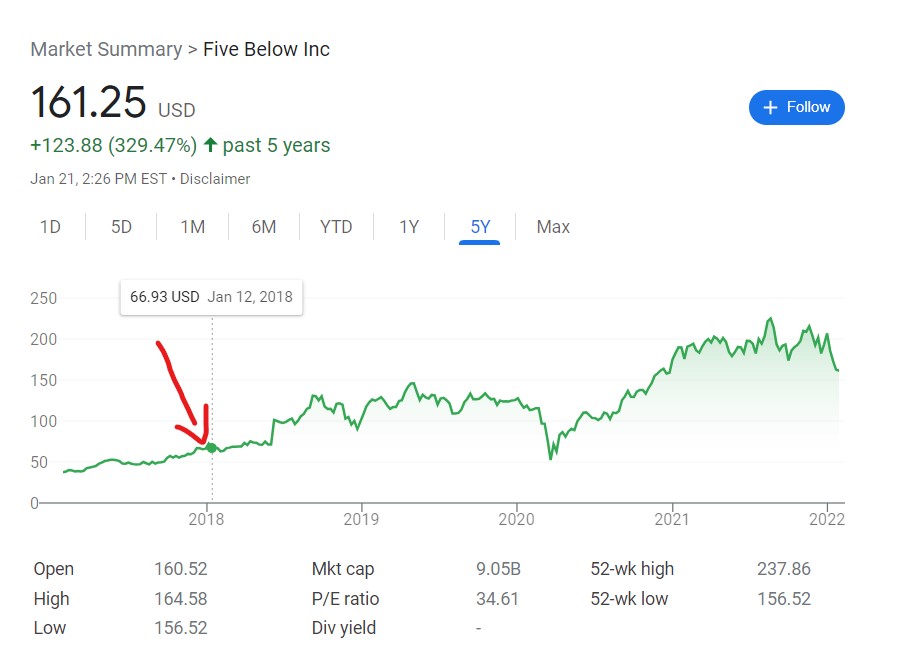

For example, in 2018 he listed Five Below as one of his 5 best stock picks for the year.

This chart below shows when Cintolo recommended Five Below (red arrow) and what this price is below:

The price has tripled in a few years.. not a bad investment if you pulled the trigger when Cintolo recommended!

He's routinely recognized for his great picks and in 2018 his picks got returns of 81%.

The S&P 500 had negative returns that year.

So mark is someone that has proven he can beat the markets and deliver high quality, high return stock picks.

3) Cabot Offers A LOT Of Different Products

Typically this is a major red flag.

Yesterday I did a review for a financial snakes oil salesman who creates a different investing newsletter every week.

I noted this is as a bad thing because this person makes more selling products than trading.

In fact, there was no real record of this person making any trades at all.

But Cabot is different because they've been around for a long time and have an awesome reputation.

It makes sense that a company with 20 employees and that's been around for 50 years has many newsletters and services.

What you want in an investment service is a track record of success.

Cabot has that.

If you're just looking for one product from Cabot I'd probably go with Cabot Growth Investor.

That's their most well known newsletter and is run by Cintolo.

4) Cabot Wealth Network Has A Very Active Blog

Cabot has something called the Daily which is basically an investment blog.

If you're unsure about Cabot and want to get a sense of their style I would check it out.

They post a new article everyday and many of them are interesting.

For example, they recently wrote an article detailing the best stocks for under $10.

Some of their picks are:

- Prospect Capital Corp.

- Energy Transfer LP

- DigitalBridge Group

You can track these stocks to see how well they do and see if they're as good as Cabot says they are.

If you prefer video over reading, Cabot has a Youtube channel where they upload a video once a week:

5) They Offer A Free Monthly Report

The reason Cabot has an active blog is so they can drive traffic from search engines and social media to their website.

Once a person is on their site they offer a free report of the month's 5 best picks.

Getting people's emails helps them make sales down the road but the newsletters do offer a lot of value.

For instance, this month (January 2022) the following were the 5 best picks:

This is another opportunity for you to track free picks to see how well they do.

6) Cabot Developed Their Own Indicators

Cabot has a unique investing style that they developed over the last 50 years investing.

One of their main indicators is called Cabot Tides Market Timing Indicator.

This indicator looks at 5 different indexes to predict where the intermediate direction of the stock market is going.

The indexes looked at are:

- S&P 500

- NYSE Composite

- Nasdaq Composite

- S&P 600 Small Cap

- S&P 400 Mid Cap

If 3 out of 5 of these indexes are in the green then the stock market will also be in the green for the near future.

If the opposite is happening with 3 of the indexes than the stock market will be red for the near future.

Next they compare each index to its own 25 day and 50 day moving averages.

If the index is above these two moving averages the index is bullish.. if it's under than the index is down.

They have indicators that determine long term trends in the stock market as well.

Both of these indicators are well tested and respected.

They were able to navigate the bumpy 2008-2009 recession because of them.

Lastly, they have indicators for emerging markets (Cabot Emerging Markets Timer) and indicators for market tops (Two Second Indicator).

Recommended: The Best Place To Get High Return Stock Ideas

Cabot Wealth Network Product Overview

Cabot has a TON of different services and products.

Here's a brief summary of each product and what you get:

Cabot Prime Pro ($3,997)

Cabot Prime is the big enchilada and the most expensive product offered by Cabot Wealth Network.

Essentially this membership gives you everything Cabot sells for a yearly fee of $3,997.

This may seem high but if you add up all the products at Cabot you're actually saving $16,000+.

However, I wouldn't recommend you start with this membership - that'd be crazy.

You should buy one of the cheaper investment letters and see how you like it.

If you're making money and getting returns then make the decision if this service is right for you.

Besides getting all the newsletters and access to the Cabot advisory team you get the following:

- Weekly Summary of all trade picks from analysts

- Weekly Q&A

- Quarterly conference call with Prime members

- Priority support

- Cabot Options Trader and Cabot Options Trader Pro

- Daily email alters and trade recommendations

Cabot Prime is essentially the same offer except you don't get the two option products.. it costs $1000 less per year.

Overall, it's a great deal but again.. work your way up to it.

Cabot Retirement Club ($497)

Cabot Retirement Club is run by Tom Hutchinson.

This product is for people that are retired or close to retired.

Essentially it teaches you how to invest for retirement and earn income through dividends.

The price is pretty fair and worth considering if you're near retirement.

Advisories

Advisories are just different investment newsletters that Cabot offers.

They typically focus on one aspect in the investment world and there's a lot of different options.

Here's a summary of each one:

- Cabot Dividend Investor: This newsletter is a part of the retirement product I just talked about. This costs $297 per year and shows you how to make monthly income with dividends.

- Cabot Early Opportunities: This monthly investment newsletter is for people looking for small cap companies with opportunity for huge growth (think early Google). It costs $797 per year.

- Cabot Explorer: This bi-monthly newsletter focuses on emerging markets and gives you 3 various stocks in these markets. It costs $997 per year.

- Cabot Growth Investor: This is the flagship product at Cabot has been around since the start of the company in 1970. You get various newsletters and free reports here.. you'll also get stocks picks and updates based on their portfolio. It costs $497 per year.

- Cabot Income Advisor: This is another newsletter that covers dividends. It also looks for safe stocks for more risk adverse investors. It costs $397 per year.

- Cabot Marijuana Investor: This monthly investment newsletter focuses on the marijuana industry. You also get weekly updates on all positions recommended. It costs $497 per year.

- Cabot Micro-Cap Insider: If you're more interested in smaller companies this newsletter is for you. The reason you would be interested in these companies is there's a lot of room for growth and they out perform large cap companies. It costs $997 per year.

- Cabot Options Trader: There's two versions of this offer.. the second is the pro version that costs more. These newsletters focus on option trading. This newsletter is currently closed to new subscribers.

- Cabot Profit Booster: This monthly newsletter focuses on growth stocks and is run by Jacob Mintz. It costs $397 for the year.

- Cabot Small Cap Confidential: Here we have another monthly newsletter focused on small cap companies. This one is run by Tyler Laundon. It costs $1,997 for the year.

- Cabot Stock Of The Week: This newsletter borrows from 7 other newsletters at Cabot. It gives you the best stock pick of the week based on those newsletters. It costs $1,497 per year.

- Cabot Top Ten Trader: This newsletter is weekly and is only for people with experience. You get 10 stock recommendations with in depth analysis on each. It costs $397 per year.

- Cabot Turnaround Letter: Cabot Turnaround Letter focuses on stocks that have been undervalued after positive change was made. This is a monthly newsletter and costs $497 per year.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

My Thoughts On Cabot Wealth Network

There's a lot to unpack with this company.

Here's may takeaways about Cabot Wealth Network:

Start With Cabot Growth Investor

This is the product that started Cabot Wealth Network 50 years ago.

Besides being a long running newsletter it get's a lot of awesome reviews.

Out of 75 people that have rated this newsletter it gets a very respectable 4.1/5:

Most investment newsletters are not this popular.

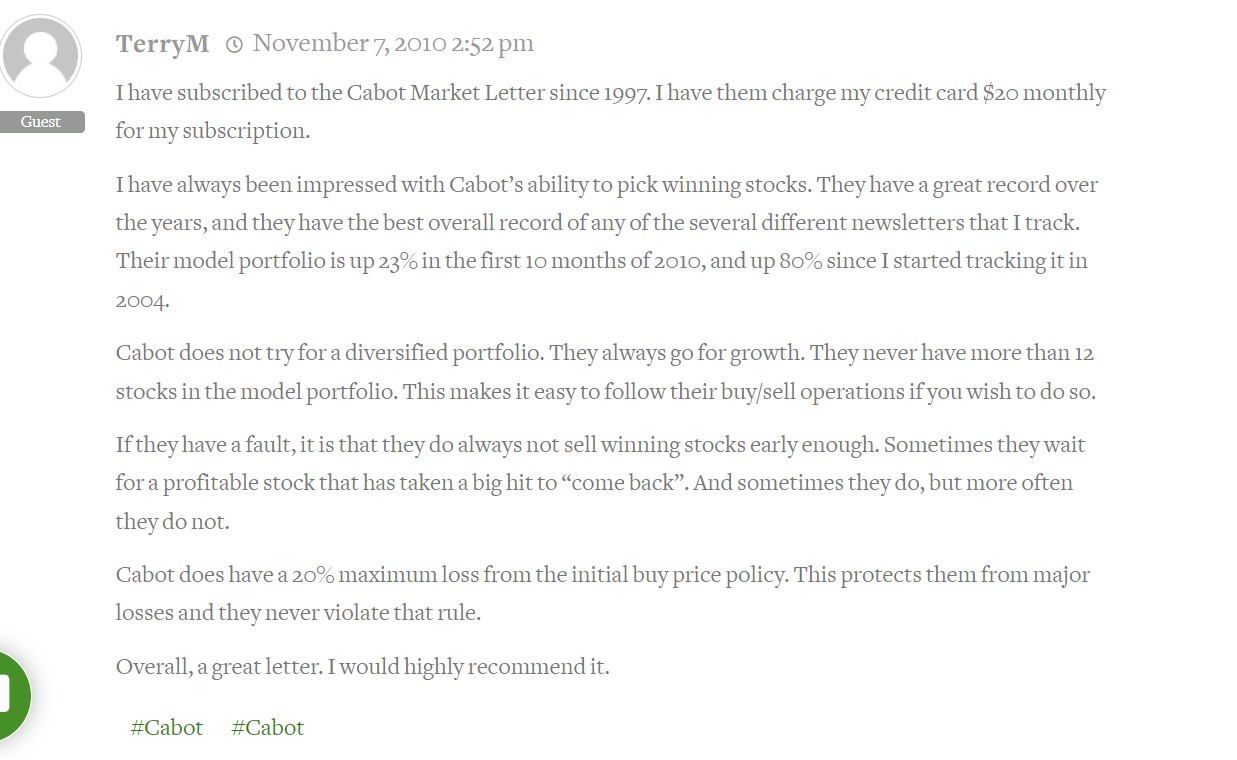

Here's a good review from someone that's been a member for 13 years:

You can definitely find winning stock picks with this newsletter.. no one sticks around for 13 years if there were too many losers!

Most Products Are Well Priced

There were a few newsletters that are pretty expensive.. like the ones that cost $1,997 per year.

I'm not sure I would recommend them.

But there are plenty of other newsletters that are affordable.

Many are $397 or $497 for the year.

Growth Investor is only $497 for the year.

The Prime Pro Membership is also an excellent value if you can afford $3,997 for the year.

You get everything and then some with this membership.

Like I said in the last section, though, start small.

Get Growth Investor and then see if you want to get the rest of the services.

Good Refund Policies

You can draw a lot of conclusions about a financial product based on their refund policy.

I am constantly coming across ultra expensive trading programs that don't offer refunds.

Major red flag.

If you believe in your product and actually help people make money refunds will be low.

All of Cabot's products come with a good refund policy.. you know they believe in what they are selling.

Not All Products Have Great Customer Reviews

A lot of Cabot newsletters have awesome ratings from customers.

The top ones are:

- Cabot Small Confidential

- Cabot Options Trader

- Cabot Growth Investor

But there's a couple that just get average reviews.

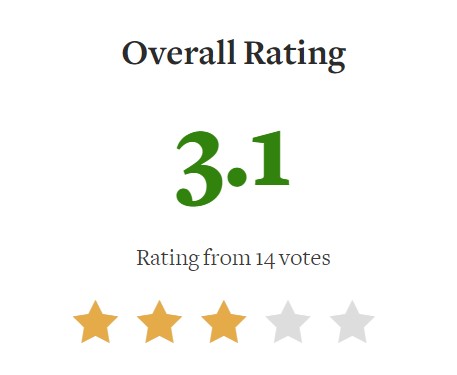

For example, Cabot Global Stocks Explorer gets a mediocre 3.1/5:

This isn't terrible but it's not as good as their other products. Plus it's semi-expensive at $997 per year.

Recommended: The Best Place To Get High Return Stock Ideas

Cabot Wealth Network Pros And Cons

Cabot Wealth Network Conclusion

I've been reviewing investment and trading products for a while now.

You get a little cynical when you've seen as many scams as I have.

Whenever I research a new company my starting position is they're scamming people.

It takes a lot for me to say otherwise.

Cabot Wealth Network is definitely a company that makes me say otherwise.

It's rare to see an investment newsletter be in business so long and have members for decades.

That alone shows that the company is legit and people are making money.

Cabot may not be under the same leadership as it was in 1970 but the place seems to be in good hands.

I like Cabot a lot and think they're one of the good investment resources available.

My only suggestion is start with Growth Investor and work your way up.

There's no need to rush into the expensive programs.. Cabot will be around for a long time.

Here's A Better Opportunity

I like Cabot Wealth Network but there's better investing newsletters out there.

I've reviewed hundreds of these programs.

My favorite place to get high return stock ideas (that's very affordable), is below:

Get High Return Stock Ideas!

See where I get my winning stock ideas below: