Today we're going to be looking at Colin Tedards and his newest stock teaser.

In this teaser, he claims to know a Google secret supplier that will eventually kill ChatGPT.

Colin is calling this secret company is "#1 AI Stock."

Of course, Tedards wants you to pay him to learn the name of this stock, but I have good news.

He left enough clues in the presentation to figure out the name of the stock, and I reveal it below for free.

On top of that, I'll give you information on the stock so you can determine if it's worth buying or not.

Let's get started!

Recommended: If you're looking for the best place to get stock picks (which is only $1 to try), click below:

Chips And AI

Before I reveal the name of the stock Colin is pitching, I want to breakdown the teaser.

This teaser isn't actually talking about an AI company but instead one of the companies that supplies semiconductors for AI.

Semiconductors play a crucial role in the growth and advancement of Artificial Intelligence (AI) for several reasons:

Processing Power: Semiconductors, particularly in the form of microprocessors and GPUs (Graphics Processing Units), provide the necessary computational power for AI algorithms. These algorithms often require high levels of parallel processing, which modern semiconductors are designed to handle efficiently.

Data Handling and Storage: AI systems need to process and store vast amounts of data. Semiconductors are integral to the memory and storage solutions (like SSDs and RAM) that enable quick data access and handling, which is essential for machine learning and data analytics.

Energy Efficiency: As AI systems grow more complex, they consume more power. Advances in semiconductor technology, such as the development of smaller, more efficient chips, help manage and reduce the energy consumption of AI systems, making them more sustainable and practical for widespread use.

Miniaturization and Integration: The ongoing miniaturization of semiconductor components allows for the integration of AI capabilities into a wider range of devices, from smartphones to IoT (Internet of Things) devices. This expands the applications and impact of AI in everyday life.

Innovation in AI-specific Chips: The growth of AI has spurred the development of specialized semiconductor chips, such as TPUs (Tensor Processing Units) by Google and NPUs (Neural Processing Units), which are optimized specifically for neural network computations and machine learning tasks.

Enabling Advanced Technologies: Semiconductors are foundational to technologies like robotics, autonomous vehicles, and smart systems, all of which rely heavily on AI. The performance and capabilities of these technologies are directly linked to advancements in semiconductor technology.

Global Economic Impact: The semiconductor industry is a significant part of the global economy. The demand for advanced semiconductor technology driven by AI applications stimulates economic growth, research, and development in this sector.

In summary, semiconductors are the backbone of modern AI systems, providing the computational power, efficiency, and innovation necessary for the continuous growth and evolution of AI technologies. Their development directly impacts the capabilities, applications, and accessibility of AI in various fields.

AMD Is The Stock Colin Is Pitching

Advanced Micro Devices, Inc. (AMD) is a multinational semiconductor company based in the United States. It's well-known for its contributions to the computer processor and related technologies market. AMD designs and manufactures microprocessors for the computer and consumer electronics industries. The company is a major competitor to Intel in the CPU market and to NVIDIA in the GPU (Graphics Processing Unit) market.

AMD's products are used in a variety of applications, including personal computing, gaming, and in data centers. In the context of AI (Artificial Intelligence), AMD's products, particularly its GPUs and high-performance CPUs, are increasingly important for several reasons:

Processing Power: AI and machine learning algorithms require significant computational power, particularly for tasks such as training large neural networks. AMD's high-performance CPUs and GPUs offer the necessary processing capabilities to handle these computationally intensive tasks.

Parallel Processing: GPUs are particularly well-suited for AI workloads because they are capable of parallel processing, which means they can perform many calculations simultaneously. This is crucial for the matrix and vector computations that are common in machine learning and deep learning.

Data Centers and Cloud Computing: AMD's processors are used in servers that power data centers, including those used for cloud-based AI services. Their efficiency and performance are key in these environments where power consumption, space, and speed are critical factors.

Graphics and Visualization: In addition to their computational abilities, GPUs are also used for rendering and visualizing complex datasets, which is an important aspect of AI in fields like data science and medical imaging.

Consumer Electronics and Edge Computing: AMD's technology is also found in consumer electronics and devices that are increasingly incorporating AI features, such as smart home devices, where local processing (edge computing) is often necessary for quick AI-based decision-making.

Research and Development: AMD invests in research and development to advance their technologies, including specific optimizations for AI and machine learning, ensuring their products remain competitive and effective for these applications.

Overall, AMD plays a significant role in the AI ecosystem, providing essential hardware that powers a wide range of AI applications, from large-scale cloud computations to personal and edge devices.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

Why You'd Want To Invest In AMD

Investing in Advanced Micro Devices, Inc. (AMD) can offer several potential benefits, reflecting both the company's position in the technology sector and broader market dynamics. Here are some pros of investing in AMD:

Strong Market Position: AMD has established a strong position in the CPU and GPU markets, competing effectively against major players like Intel and NVIDIA. This competitive stance can be attractive to investors looking for companies with a solid market presence.

Diverse Product Portfolio: AMD's diverse range of products, including processors for personal computers, servers, and graphics, provides a degree of diversification within the tech sector. This diversity can help mitigate risks associated with reliance on a single market segment.

Growth in High-Performance Computing: The increasing demand for high-performance computing in areas such as AI, machine learning, and data centers can drive growth for AMD. Their products are well-suited to these applications, potentially leading to increased sales and market share.

Innovation and Research: AMD is known for its continuous innovation and improvements in chip technology. This focus on R&D can lead to more advanced products, helping AMD to maintain or improve its market position.

Strategic Partnerships and Collaborations: AMD often engages in partnerships and collaborations with other tech companies, which can open up new markets and opportunities.

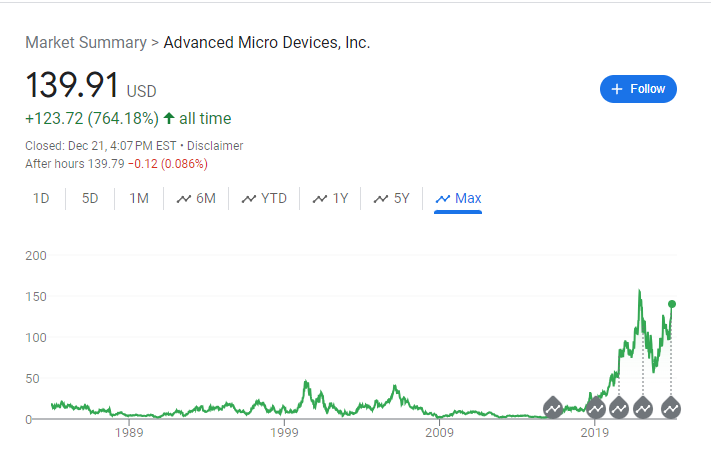

Positive Financial Performance: Historically, AMD has shown strong financial performance with significant revenue growth and improved profitability. This trend, if it continues, can be a positive indicator for investors.

Adaptability to Market Changes: AMD has demonstrated an ability to adapt to changing market conditions, whether that's shifting consumer preferences or the evolving needs of data centers and cloud computing providers.

Why You Wouldn't Want To Invest In AMD

Investing in Advanced Micro Devices, Inc. (AMD) also comes with certain risks and potential downsides, which are important to consider for a balanced investment perspective:

- Intense Competition: AMD operates in highly competitive markets, especially against giants like Intel in CPUs and NVIDIA in GPUs. This constant competition requires continuous innovation and investment, and any failure to keep up can negatively impact AMD's market share and profitability.

- Cyclical Nature of the Tech Industry: The semiconductor industry is known for its cyclical nature, with periods of high demand followed by oversupply and reduced prices. These cycles can impact AMD's financial performance and stock price.

- Dependency on Global Supply Chains: The semiconductor industry is highly dependent on complex global supply chains. Disruptions in these supply chains, such as those caused by geopolitical tensions, trade disputes, or global pandemics, can impact production and delivery, affecting AMD's revenue and growth.

- Rapid Technological Changes: The technology sector is characterized by rapid and continuous evolution. AMD needs to constantly innovate to stay relevant, which involves significant research and development expenses. Failure to keep pace with technological advancements can quickly render products obsolete.

- Economic Sensitivity: Demand for AMD's products can be sensitive to broader economic conditions. In economic downturns, spending on technology hardware and software often decreases, which can negatively affect sales.

- Regulatory Risks: Changes in international trade policies, tariffs, and intellectual property laws can significantly affect AMD's operations, especially since it has a global manufacturing and sales footprint.

- Market Expectations: AMD's stock price often reflects market expectations for future growth. If the company fails to meet these expectations, even if it posts solid results, its stock price can be negatively affected.

- Potential for Market Saturation: As the demand for certain types of processors matures, there could be a risk of market saturation, which can limit growth opportunities for AMD.

What Do Experts Think Of AMD?

Experts' opinions on AMD (Advanced Micro Devices) stock in 2023 present a generally positive but mixed outlook. Here are some key points from the analysis:

- Price Targets and Ratings: Various analysts have given AMD a range of price targets and ratings. For instance, some analysts have lowered their target but maintained an "Overweight" rating, indicating a positive view but with a cautious approach to the target price. Others have boosted their target while maintaining a "Buy" or "Positive" rating, suggesting confidence in the stock's potential growth.

- Factors Influencing the Outlook: The outlook for AMD stock involves considering several factors, including technological advancements, market demand, and competitive positioning. AMD's consistent product innovations and increasing market share are cited as positive aspects. However, forecasts remain subject to variables like global economic conditions, supply chain disruptions, and overall demand for semiconductor products.

- Volatility and Growth Potential: AMD's stock reflects the dynamic nature of the semiconductor industry. Historical trends and patterns indicate both volatility and growth potential. Technical analysis is often used by investors to assess market trends and make informed decisions.

- Dividends and Earnings: AMD, like many tech companies, has traditionally not offered dividends, focusing instead on reinvesting profits into research and development. This strategy aims to sustain the company's competitive edge in the market. Investors typically look to the company’s earnings reports to evaluate its financial health and growth potential.

AMD Vs Nvidia

When comparing investing in AMD vs. NVIDIA in 2023, several factors need to be considered, and expert opinions vary:

Performance and Market Position: Both AMD and NVIDIA have had decent performances in 2023, outpacing the market with impressive year-to-date growth. NVIDIA has a significant lead in AI chips, which is a growing market, and its revenues in this sector are strong. On the other hand, AMD has shown robust performance in sectors like laptop chips and has a more diverse business than NVIDIA, potentially offering a more stable investment.

AI and Software Strength: NVIDIA leads in AI, not just with its hardware but also with its software stack. This software dominance gives NVIDIA a competitive advantage, as many AI applications rely on NVIDIA's CUDA platform. While AMD is also growing in the AI space, it hasn't matched NVIDIA's software ecosystem. This difference could be crucial for future growth, especially in AI and data center applications.

Valuation and Growth Prospects: From a valuation perspective, AMD's stock is seen as more affordable compared to NVIDIA, which might suggest a better entry point for investors. AMD is viewed by some analysts as a classic turnaround stock, indicating potential for recovery and growth. NVIDIA, with its higher valuation, is considered overvalued by some analysts, although it still holds significant growth potential due to its strong position in AI and data centers.

Investment Strategy Considerations: For long-term investors, both AMD and NVIDIA are considered excellent choices due to their strong market positions and growth potential in key technology areas. However, the choice between them may depend on individual investment strategies and how each investor weighs factors like current valuation, growth prospects, market dominance, and sector-specific strengths.

AMD Alternatives

Nvidia isn't the only chipmaker alternative to AMD.

Here are some other semiconductor companies that are benefiting from AI mania:

- Taiwan Semiconductor (TSM): As a leader in semiconductor manufacturing, TSM's capabilities are crucial for producing the complex chips required for AI technologies. Its consistent growth and major role in the semiconductor industry make it a significant player.

- Intel (INTC): Intel, one of the largest chip makers, has developed AI chips like the Gaudi AI chip, which shows potential in handling large language models. Despite some challenges, Intel remains a key player in the AI chip market.

- AMD (AMD): Known for its graphics cards and GPUs, AMD focuses on addressing the representation of knowledge problems in AI, making it a relevant choice in the AI chip sector.

- IBM: IBM has made significant advances with its neuromorphic chip, designed for efficient deep network inference and high-quality data interpretation, important for AI applications.

- Google Alphabet: Google's Cloud TPU and Edge TPU are specialized for machine learning and edge devices, respectively, showing the company's commitment to AI hardware.

- SambaNova Systems: Founded in 2017, SambaNova Systems focuses on developing high-performance hardware-software systems for AI applications and builds data centers for businesses.

- Cerebras Systems: Known for its Cerebras WSE-2 chip, which has a vast number of cores and transistors, Cerebras Systems is making strides in accelerating genetic and genomic research and drug discovery.

- Graphcore: This British company has developed the IPU-POD256 and works with several research institutes, emphasizing its focus on AI chip technology.

- Groq: Groq's unique AI chip architecture aims to simplify system adoption for companies, marking it as an innovative player in the AI chip market.

- Mythic: Mythic has developed products like the M1076 AMP, attracting significant funding and interest in the AI chip sector.

- Amkor Technology (AMKR): As a packaging and test service provider for chip manufacturers, Amkor supports the success of AI chips in the semiconductor industry.

- ON Semiconductor (ON): This company has demonstrated impressive growth and diversification across sectors like AI, vehicle electrification, and 5G.

- Broadcom (AVGO): Broadcom is pushing boundaries in AI networking with innovations like the Jericho3-AI, which could significantly impact AI workloads.

- VanEck Semiconductor ETF (SMH): For a diversified investment in the semiconductor industry, SMH includes holdings in leading companies like NVDA and TSM.

These companies represent a mix of established giants and rising stars in the semiconductor and AI fields, each contributing in different ways to the growth of AI technologies.

Conclusion

That's the end of my review of Colin Tedard's latest stock teaser.

What do you think of all of this?

Do you think AMD will help dethrone ChatGPT and become a good investment?

Let me know in the comments!

Get High Return Stock Ideas!

See where I get my winning stock ideas below: