Hey, what's going on, investors?

Today we're going to be taking a look at Innovation Investor by Luke Lango.

I bought this service and will be exposing how it's performed over the last couple of years in the review.

Additionally, I'll be sharing any red flags about this service that I can find (and there are plenty of red flags).

Let's get into looking at this newsletter now.

Innovation Investor Summary

Owner: Luke Lango

Price: $49 for first year, $199 per year after

Rating: 2.5/5

Do I Recommend? Not really

Summary: Innovation Investor is a newsletter that's really high-risk and high-reward.

Many of the companies that Luke likes to recommend are smaller and can be volatile (although there are plenty of large-cap stocks as well).

Additionally, there are over 60 stocks in the portfolio, which will be overwhelming for a lot of people.

The main reason I don't recommend this service is that there are some massive losers that outweigh the wins, in my opinion.

On top of that, this newsletter is owned by a rotten company headed by a legitimate fraudster.

Top Alternative: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

The Biggest Red Flag About Innovation Investor

There are a few red flags about Innovation Investor, but the biggest one is that it's being sold at Investorplace.

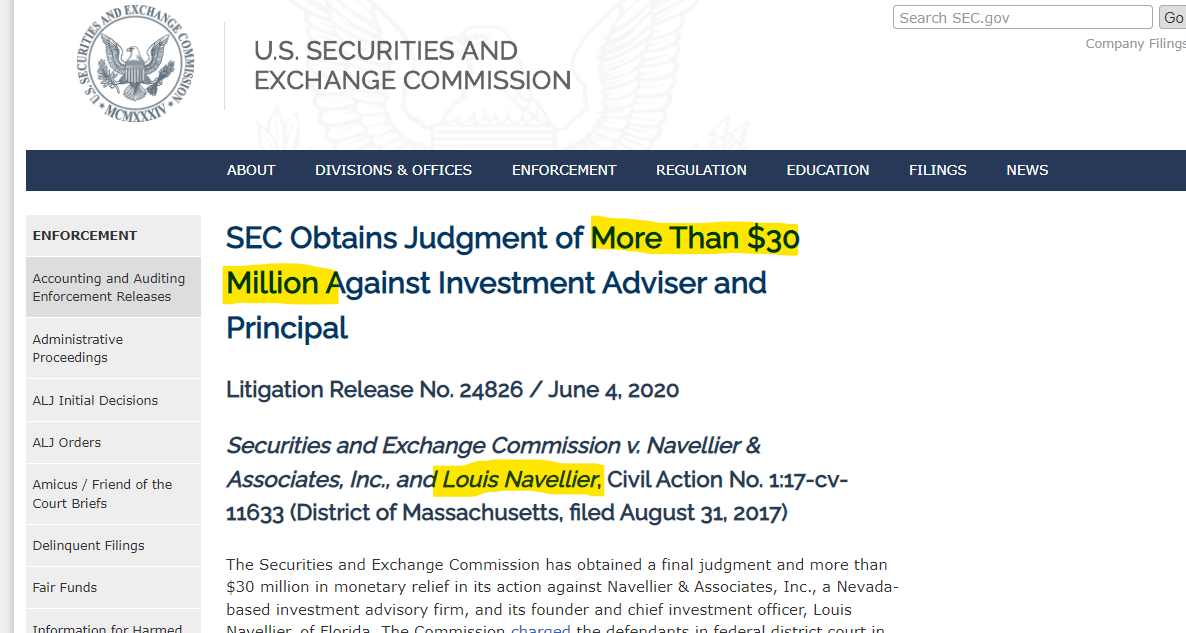

Investorplace is a publisher that sells many other investing newsletters and is headed by a guy named Louis Navellier.

Louis Navellier, in my opinion, is one of the worst characters in the entire stock-picking world.

Besides being a repulsive figure who seems to make his entire persona about how rich he is, he's also a downright fraudster.

A couple years ago, he was fined $30 million for defrauding his customers.

So what does this have to do with Luke Lango?

Well, first of all, you're putting money into Louis' pocket if you buy Innovation Investor because he owns the publishers.

Secondly, InvestorPlace is very aggressive with their upsells, and you'll be heavily promoted in Louis' newsletters as well.

Some of Navellier's services cost over $10,000 per year!

I personally wouldn't feel comfortable giving Louis my money.

The Other Big Red Flag

There's one more red flag about innovation investors I want to talk about before moving on.

InvestorPlace owns this newsletter, but a bigger company owns InvestorPlace, which is called MarketWise.

MarketWise is a publicly traded company that owns over a dozen investing publishers.

The problem with Innovation Investor being owned by MarketWise is that MarketWise is a very predatory company.

They really like to nickel and dime their customers.

Their main way of doing this is by sending out upsells and stock teasers to their customers.

I'm sure if you're here reading this review, it's because you saw some flashing stock teasers from Luke Lango, hyping up an investment opportunity.

These stock teasers are often very misleading and overstate how much you can make.

Luke has done a ton of stock teasers where he promised massive returns that eventually turned into massive losses.

On top of that, MarketWise engages in other bad business practices and employs other fraudsters as well (like Teeka Tiwari).

Again, another place I personally wouldn't want my money going.

Recommended: The Best Place To Get Stock Picks

A Look At Some Of Luke Lango's Stock Picks

Later on, we'll look at the entire portfolio and how it's performing.

Before we do that, I want to cover some of the stock teasers that Luke does.

The stock teasers are the main way that Luke sells his newsletters.

They're very persuasive, and by the time you're done watching, you're probably reaching for your credit card.

I want to share with you the results of these teasers so you can get a real idea of the results you will get.

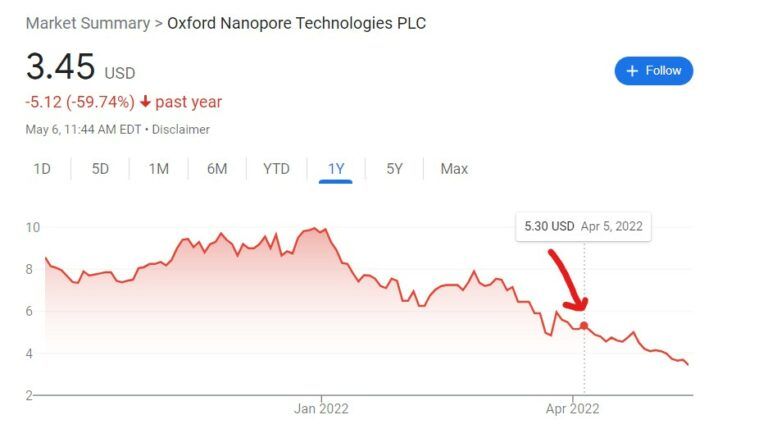

Oxford Nanopore In April 2022

In this teaser, Luke promoted a business he said would become the next big name in DNA sequencing.

He was referring to Oxford Nanopore.

Luke is so fond of this selection since he trusts the company's patented technology.

Check out the stock price below:

Although this company has only been publicly traded for six months, the price was clearly too high before it began to fall.

Its current price of $3.45 looks like a lot more reasonable to pay to purchase.

This is a long-term investment that depends on DNA sequencing's expansion in the coming years.

Oxford Nanopore is a long-term investment, so it's not really a huge problem if it has fallen off since Luke suggested it.

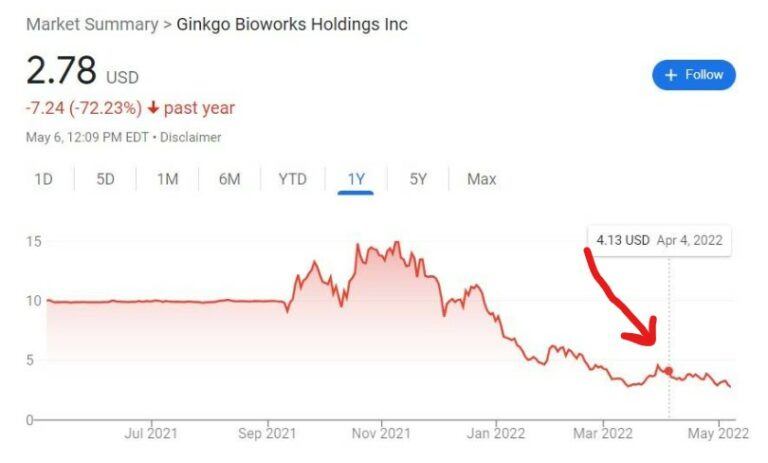

Ginkgo Bioworks in April 2022

Luke was promoting Ginkgo Bioworks at the same time as the last teaser presentation.

This business manufactures synthetic cells for use in food and medicine.

The stock price was inflated during COVID, as it was with many of these businesses.

The stock's performance throughout the previous year was as follows:

A lot of people under the MarketWise umbrella were recommending this stock last year.

Many people think this company is a straight-up scam and pays people to promote their stock.

That could definitely be happening here.

Regardless, the stock has lost more than half of its value since being recommended.

Ilika in February 2022

Luke recommended this stock as his "#1 forever battery stock."

Apparently, they make solid-state batteries that are supposed to last longer on a charge.

When Luke first started running this teaser, he referred to it as a "$3 stock."

This stock has performed horribly, though, and has lost most of its value since being recommended by Luke:

That's a pretty big loss for anyone who invested in this stock.

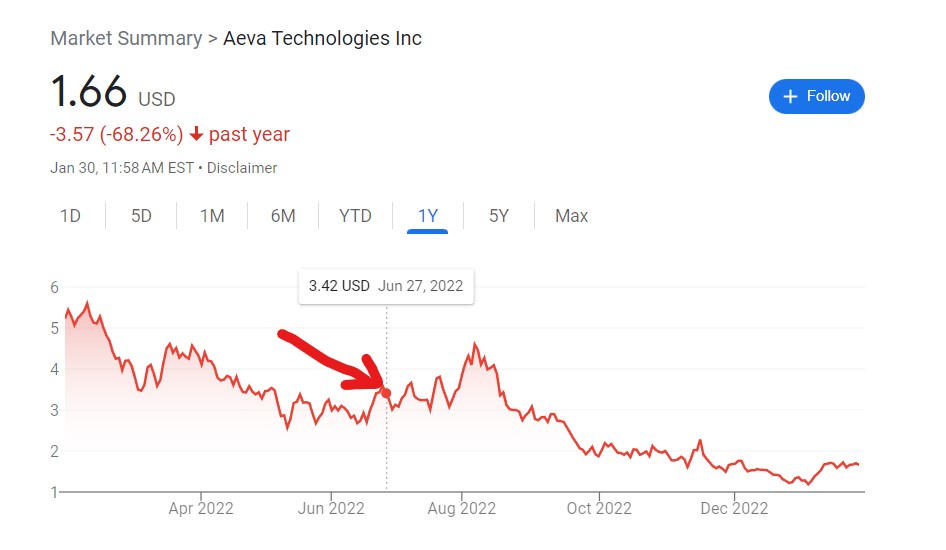

Aeva in June 2022

Aeva is a LiDar company, which means they make products that help cars drive themselves.

Luke was very speculative with this pitch and claimed Aeva would eventually team up with Apple to make a self-driving car.

That hasn't come to fruition yet, but the stock has lost more than half of its value.

As you can see these teasers make grand promises and predictions.

But it doesn't seem to work out to often.

A Peak At The Portfolios

Innovation Investor is a little different than other investing services.

Most of the newsletters I review have around 20 stock picks in their portfolio.

Luke's newsletter is more like an EFT and has around 60 to 70 stock picks in it at any given time.

This can definitely be a little overwhelming for an investor because there are a lot of stocks to track.

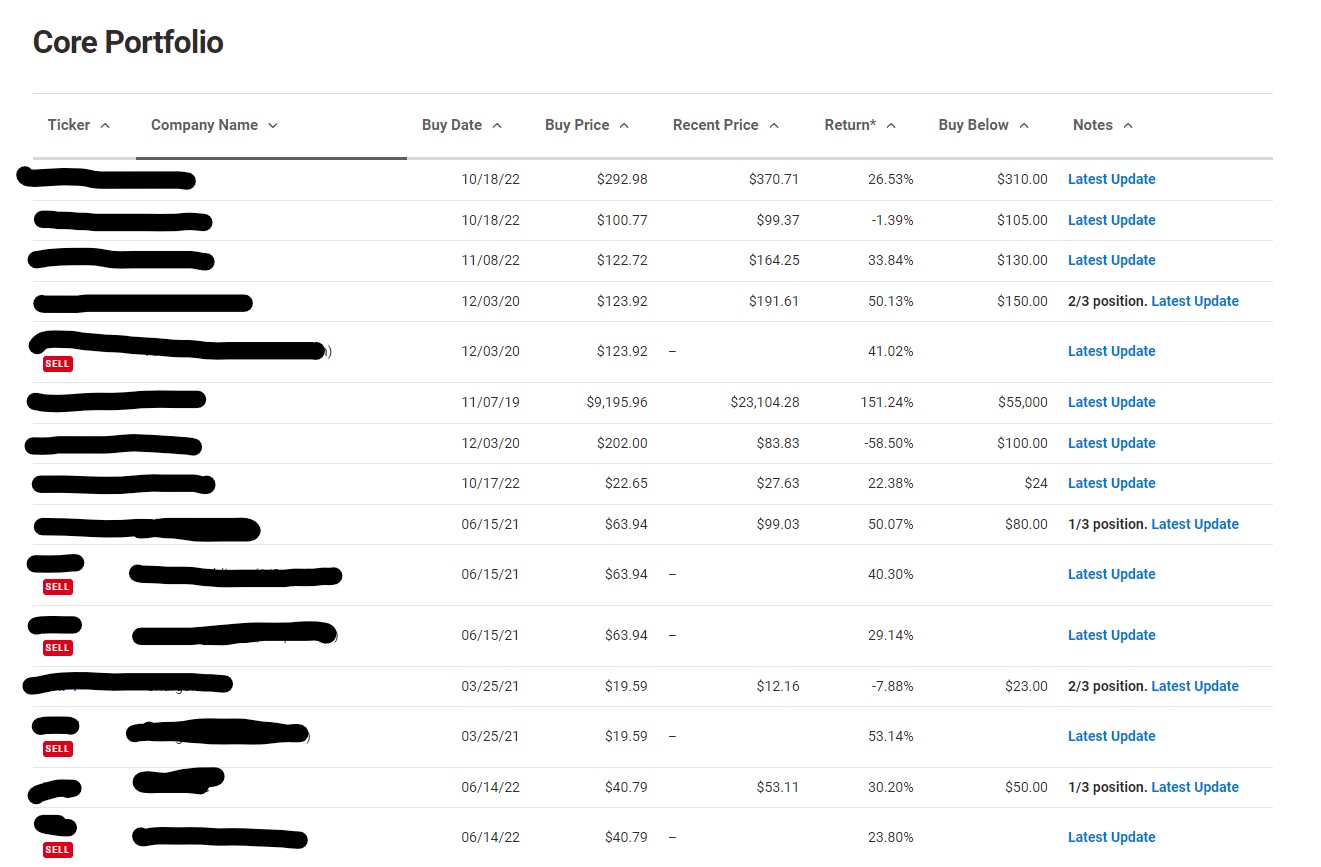

Additionally, there are two different portfolios at Innovation Investor.

The first is the "core" portfolio, where the majority of the holdings are.

This is a mixture of medium and large tech stocks.

Here's a screen shot with the performance of some of the stocks:

These are considered "mid-risk, mid-reward" by Luke.

This portfolio isn't too bad.

There are plenty of big-time losers, but there are some triple-digit winners as well.

Luke's current biggest three winners are 623%, 242%, and 197%.

Luke's current biggest losers in the portfolio are 75%. 68% and 67%.

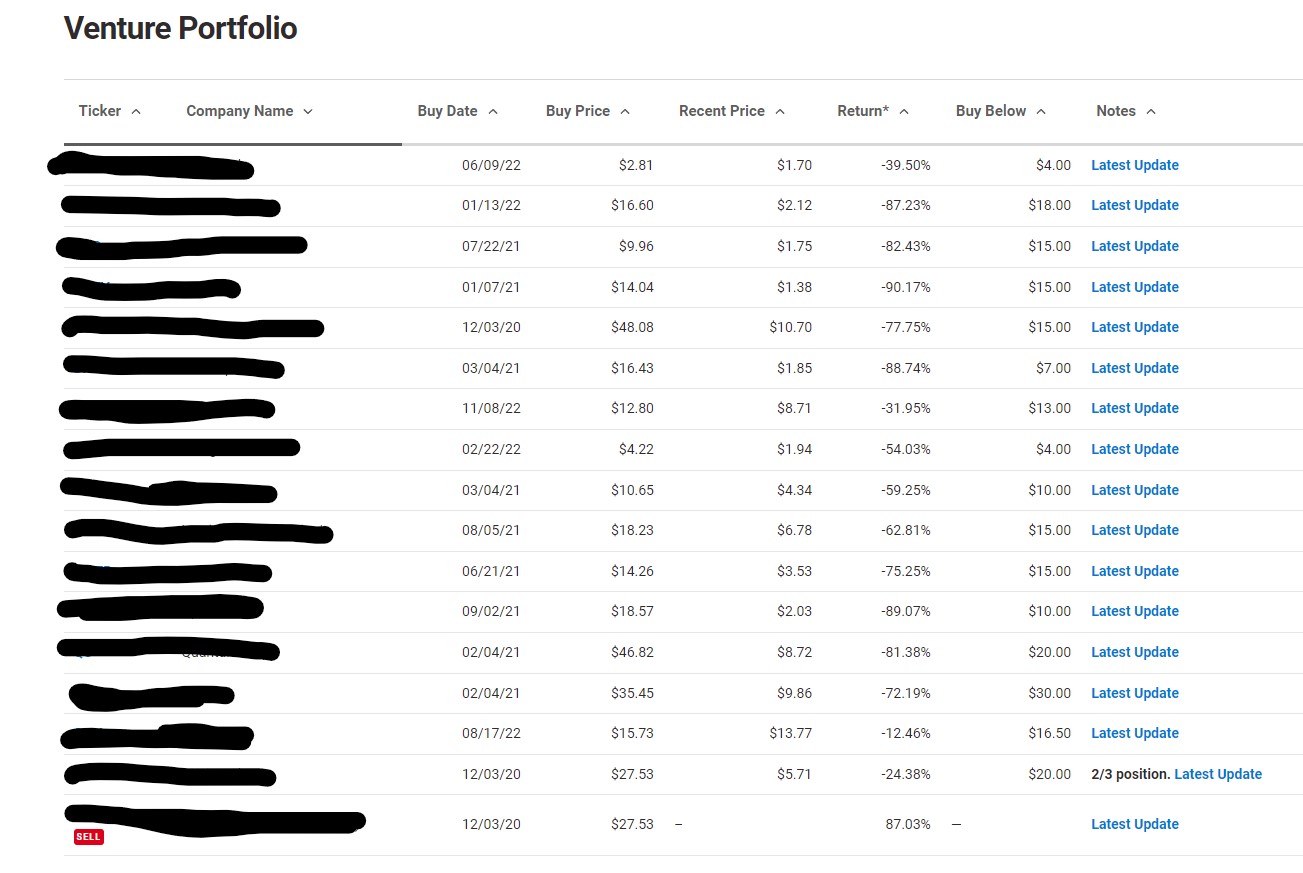

The next portfolio is called the "Venture" portfolio, and this is made up of "high risk, high reward" tech stocks.

So far, it seems all high-risk, though:

As you can see basically every stock in this portfolio is down very big except one stock.

So if you do decide to buy Innovation Investor I would probably stay away from this portfolio.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

Here's Everything You Get At Innovation Investor

Besides the amount of open positions in the portfolio, this newsletter is pretty standard stock picking service.

Here's everything you can expect from Innovation Investor:

Monthly stock picks

This is the main part of the offer and essentially what you're paying for.

Once a month, Luke will send you a new stock pick that he and his team like.

With this stock pick, there will be a write-up of why Luke likes it and what he expects from it.

Here's an example of the write-up you get:

This stock pick is related to "quantum computing," and the company being recommended is IonQ.

The write-ups are pretty brief and easy to read.

Trade Alerts

Many of the stock picks that Luke recommends are very risky, volatile, and unproven.

Because of this, sometimes an alert will go out to sell or buy.

So let's say something bad happens to one of these stocks. Luke will send you an alert to sell.

There are also daily notes about the performance of the portfolio and the market.

Portfolio

The portfolio is the other main aspect of this offer.

We looked at the two portfolios in the last section, and the mid-risk one definitely outperforms the high-risk one by a lot.

What Kind Of Stocks Are Recommended?

As you can tell from this review so far, Luke likes to recommend tech stocks.

These stocks are definitely on the growth side and are ones that are at the forefront of technological advances.

Luke claims his stocks are in the following sectors:

- Green energy

- Electric vehicles

- Self-driving vehicles

- Space

- Blockchain

- Metaverse

- Automation

- Cellware

This is why the service is called "Innovation Investor."

These companies are all supposed to be the ones developing new technology that's going to power the future.

Each one of these sectors is one that Luke believes will dominate society.

I have my doubts about some of them, for sure.

There are new tech trends that come and go, and nothing materializes from them.

but we'll see.

Recommended: The Best Place To Get Stock Picks

Does Innovation Investor Beat The Market?

There's really no way to know for sure.

There are simply too many stocks to look at, and then you have to factor in when the stock recommendations were made, when someone bought the newsletter, etc.

However, if you were to buy this newsletter right now and put your money into all the buy recommendations and then buy all the new recommendations every month, I doubt you would beat the market.

Just by looking at how the previous stocks have performed, this just doesn't seem like a market-beating newsletter to me.

But we'll see.

Is Luke Lango A Scam Artist?

No, I don't think so (as for his boss, Louis Navellier, it's entirely debatable that he is).

Luke is just a very young guy and not that experienced, in my opinion.

According to his LinkedIn, Luke graduated college in 2017.

That means he's still in his twenties.

I don't know about you, but I personally wouldn't entrust all of my money to a guy who's only in his mid-twenties.

I personally wouldn't want someone who's experienced with stocks and has a long, proven record with my money.

Do You Recommend Innovation Investor?

So after buying this newsletter and following Luke Lango for about a year now, I don't recommend it.

There are many reasons why, which we touched on in this review.

I don't like the company that owns this service, and I don't want my money going to Louis Navellier or MarketWise.

Plus, once you buy this newsletter, you're thrown into a very aggressive and, in my opinion, very manipulative sales funnel.

You'll constantly be getting sales pitches for products that cost thousands of dollars per year and don't perform well.

There are some aspects of Innovation Investor that I like, including the price, and some stock picks have done well.

But there's too much baggage and too much risk, in my opinion.

What Are Top Alternatives?

There are a lot of investing newsletters out there.

I've personally reviewed over 100 of them.

Most aren't worth the money, and barely any of them actually beat the market.

However, there's one newsletter that I definitely recommend, and that's the Insider Newsletter.

This newsletter is only $1 to try and has performed the best out of all the newsletters that I've seen.

To learn more, click below:

Get High Return Stock Ideas!

See where I get my winning stock ideas below: