The Altucher's Investment Network is an introductory investing newsletter from James Altucher.

This product offers tips on how to make money with stocks, crypto, and other opportunities.

If you're here, I'm guessing you want to know if it's a scam before pulling the trigger.

This review will help shed light on this.

You'll get a complete breakdown of Altucher Investment Network, including background information, the price to join, what's actually being offered, and more.

You'll know if this product is worth it by the time you're done reading.

So, set aside a few minutes and read through everything.

Let's get started!

Altucher Investment Network Summary

Owner: James Altucher

Price: $299

Rating: 1.5/5

Do I Recommend? No

Summary: James Altucher is not someone I am really a fan of. To be completely honest, everything about him bothers me.

His hair, his face, the way he markets—pretty much everything.

I could forgive all of that if I thought he could make you good money, but that's not going to happen.

I've looked into years of Altucher's picks, and the results aren't good.

Many investments have lost close to 100% of their value, and others have lost similar amounts.

In the end, he doesn't beat the market, and that's all that really matters.

Not to mention, if you buy this newsletter, you'll be thrown into a marketing funnel, and your inbox is going to get flooded with expensive upsells every day.

100% avoid.

Top Alternative: I've reviewed all the top places to get high return stock ideas. To see my favorite (which is extremely affordable), click below:

5 Things To Know About Altucher's Investment Network

Before we breakdown what this product is, let's take a look at some important background information.

This is what I think is most important about Altucher's Investment Network:

1) It's Run By James Altucher

James Altucher is the creator of this newsletter, and he's a complicated guy.

He's the type of person who can make rapid and life-changing decisions on a whim and completely reinvent his life.

Like when he lost $15 million in two years after selling one of his companies or when he sold everything he had to live out of a suitcase.

I personally believe this type of personality seems like a nightmare to deal with and be around.

I don't know about you but I personally wouldn't want to take investment advice from a guy who is comfortable losing everything he has.

Unlike many people that I review on this website, James isn't exclusively a trader and investor. In fact, it's not really what he's most known for.

Altucher is more known for the businesses and websites he's started.

In the late 1990s, he created a business called Reset Inc. and sold it for $15 million.

After losing this money, he started his investing and trading career.

2) James Gets A Lot Of Heat

A personality like James is going to attract a lot of attention and a lot of criticism.

Although people like Mark Cuban are friends with James and seemingly follow his advice from time to time, many other people are much more skeptical of James.

One thing people don't like about Altucher is that he'll peddle dubious stock picks to his large audience.

For example, James notoriously likes to recommend microcap or penny stock companies to his readers.

These are very small companies that have low stock prices; a lot of the time, they're not even listed on major exchanges.

The problem with penny stocks is that many are outright scams and ripe for pump-and-dump schemes.

Because these stocks are so cheap and rarely traded, someone with a large audience can temporarily and superficially inflate the stock's price.

Before inflating a price, a trader will load up on the stock and dump the price as it peaks.

They make money, while the people they get to buy the stock lose money.

I have no clue if Altucher is picking these microcap stocks on merit or if he's doing some sort of pump and dump scheme; he certainly has the power to raise the stock price.

Some of the picks definitely come with a lot of red flags.

3) The Crypto Genius?

James ran a very aggressive marketing campaign, declaring himself the "crypto genius."

These ads were shown all over the internet, and many different people were mocking the campaign.

Many pointed out that the tweet he Tweeted in 2013 Bitcoin was a scam and Ponzi scheme (he's since deleted the Tweet)

Again, James personality and style will always attract a lot of attention.

Although these ads were cringeworthy, you would have made a lot of money if you had listened to Jame's advice to buy Bitcoin in 2017.

Here's how much it's gained from that time to now:

Just up 3900% since then!

A $10,000 investment in Bitcoin would then be worth a cool $390,000.

Many people were calling him "the face of the Bitcoin bubble" in 2017 as well.

Bitcoin might end up being a giant bubble that pops one day, but articles declaring it a bubble in 2017 have aged like milk.

But James has made some boneheaded decisions with his crypto predictions and marketing.

He sent out an email to his followers claiming he knew Amazon was going to accept Bitcoin:

This was completely made up, and this spread around to other people making the same prediction.

After it didn't happen, James claimed it would happen in February, and again, it never happened.

Amazon explicitly stated that it has no plans to accept Bitcoin.

4) Owned by Agora Financial (Gross)

Ughhh..

Agora Financial is a company that owns a lot of the financial newsletters you see out there. They're the biggest financial newsletter distributor.

I've reviewed a lot of their products in the past, including this one, this one, and this one.

They employ some of the grimiest people in the industry, like Teeka Tiwari, who is literally banned from trading stocks on behalf of customers because of his involvement in scams.

They don't just sell financial products, though.

They have a boiler room that sells all kinds of health products as well.

Agora doesn't have a good reputation, and just recently, they were convicted of selling fraudulent diabetes cures to over 35,000 people.

They were also forced to pay $2 million in fines for selling phony financial products to senior citizens.

It doesn't get much lower than that.

Agora unfortunately owns Three Founders Publishing, which publishes Altucher Investment Network.

This isn't a good sign and means you'll be pressured through your email into buying one of Agora's other, more expensive products all the time.

Typically, I suggest staying away from anything Agora-related.

5) Altucher has recommended some stinkers.

James Altucher is constantly running promotions where he hypes up different picks.

These picks are paired with his products, and he uses them to get you to buy his newsletters.

These are supposed to be well-researched stock ideas and are usually ones James promises will make you a lot of money.

Here's a look at how some of these stock ideas have performed:

ShotSpotter in 2018

Back in 2018, James started hyping a stock, which he called "Electronic Police."

He claims a company has a new "futuristic crime fighting technology" that was going to "land in your neighborhood."

This stock turned out to be ShotSpotter.

Altucher claimed the stock would rise because it would get funding through a potential Trump infrastructure bill.

The problem, however, is that the infrastructure bill never materialized.

As a result, the following has happened with the stock:

Red arrow is when James started promoting the stock pick

As you can see, the stock has improved slightly at some points but is down overall.

Had this campaign started 18 months earlier, there would have been nice gains.

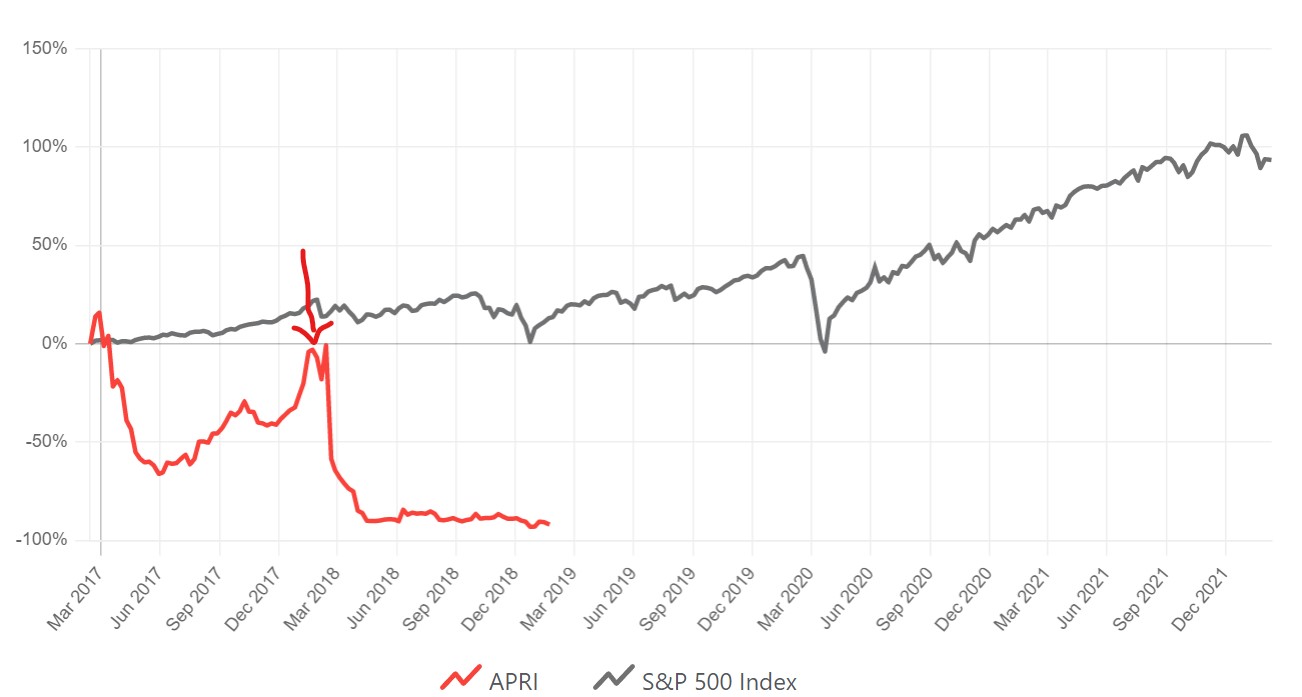

Apricus Biosciences in 2018

Apricus Biosciences is a pharmaceutical company that tried getting an erectile dysfunction cream called Vitaros approved by the FDA.

They failed in their initial attempt 10 years before James made this prediction.

However, they were giving it another shot in 2018.

Altucher marketed these stock picks as "the greatest biotech opportunity of the decade," with a chance to receive 54,000% returns.

This all hinged on the FDA approving Vitaros, but if you wanted to get maximum returns, you needed to get in before that.

So what happened?

The FDA didn't approve the drug, and the stock crashed.

Red line shows Apricus Biosciences crash and the black line shows the performance of the market

If you invested in this stock pick, you pretty much lost everything.

Auxly Cannabis in 2019

A 2019 marketing campaign focused on a marijuana stock that Altucher claimed is "the only marijuana stock you'll ever need."

Altucher claimed this Canadian company would single-handedly grow more weed than the rest of the Canadian market combined.

The company is Auxly, and here is how the stock has performed since this marketing campaign:

Another loser..

If you invested when Altucher said to, you'd be down pretty significantly now.

Altria in 2019

In June 2019, James started another marketing campaign around a marijuana company.

I guess James was hoping no one noticed he called his last marijuana stock idea "the only marijuana stock you'll ever need."

James claimed this company, called Altria, could "double your retirement" and that your "401k can't compete with it."

Here's a look at how this stock has performed since this announcement:

The stock was down for a number of years and has recently gotten back to a breakeven level.

So yeah..

Any time you see James advertising a stock pick in one of these promotions, I would stay away from it.

Better yet, you might want to shorten it!

6) AI Crown Jewel

This is the latest teaser that Altucher has been running.

In this teaser, James claims that chips will be the biggest benefactor of the massive AI trend that's taking place right now.

However, he's not recommending Nvidia, which makes the most AI chips.

Instead, he's recommending Taiwan Semiconductor, which is an absolutely massive chipmaker in Taipei.

The biggest threat with this company is that they are located in a geopolitical hotspot, and China-Taiwan relations are not good.

A war between the two nations would be devastating to the company, and this makes a lot of people very uncomfortable.

Recommended: The Best Place To Get High Return Stock Ideas

What Does Altucher Investment Network Offer?

The Altucher Investment Network comes with a few different components.

Here's a look at what you get:

- Monthly Newsletters: Every month, you get a newsletter delivered to your inbox and mailbox. This newsletter comes with stock picks, market news, and looks at additional investment opportunities. You get crypto picks here as well.

- Alerts: Sometimes a stock needs to be sold before the newsletter gets sent out. These email alerts will let you know if this is the case. You can also choose to get text message alerts as well.

- Special reports: The special reports are the stock idea promotions we covered in the last section. These are full write-ups about stocks, companies, and other investment ideas, explaining why they're worth investing in. However, as you've seen, a lot of these reports end up flopping.

- Daily Letters: You get 3 additional daily letters with this membership. This includes Altucher Confidential, One Last Thing, and a 5-Minute Forecast.

Want Winning Stock Ideas?

I've reviewed all the best places to get winning stock picks.. to see my favorite, click below:

My Thoughts On Altucher's Investment Network

There's a lot to digest here.

Here are some of the main takeaways from this newsletter:

Customer reviews aren't good.

James has been around for a while.

I noted earlier that he gets a lot of attention, and a lot of that attention is negative.

That's part of being in the light and doing the kind of marketing that he does.

So much hate from journalists and rivals is to be expected.

However, it's not a good sign when customers are negative about your service, and James has a lot of negative reviews regarding his newsletters.

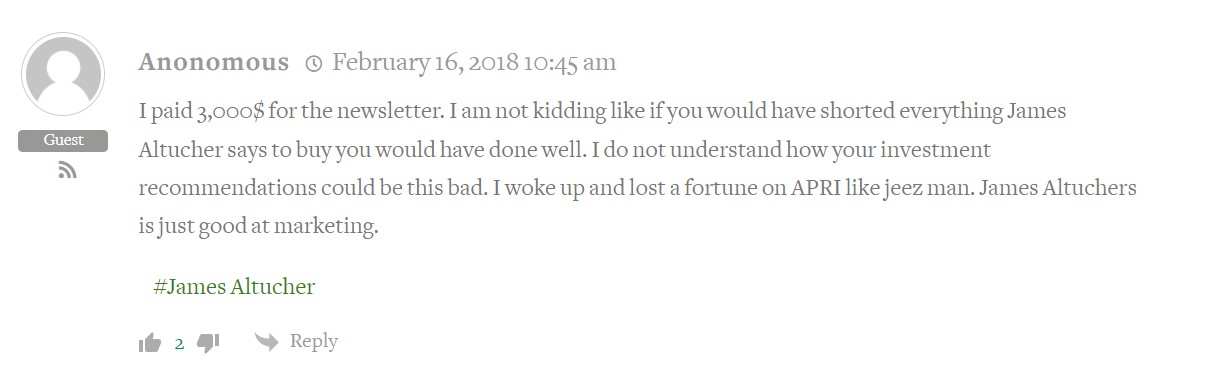

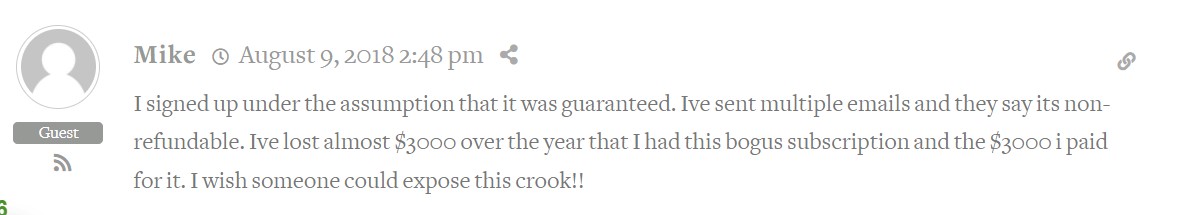

Here's a review from someone who bought one of Jame's more expensive newsletters:

The stock this person is talking about is Apricus Biosciences, which we covered up top.

Apricus Biosciences basically crashed overnight, and this person (and a lot more people) lost a fortune.

This is the kind of stuff that can happen when you follow James.

Here's what another customer had to say:

After a year of following the picks, he lost $3,000. Add that to the cost of a subscription, and he's down $6,000 for the year!

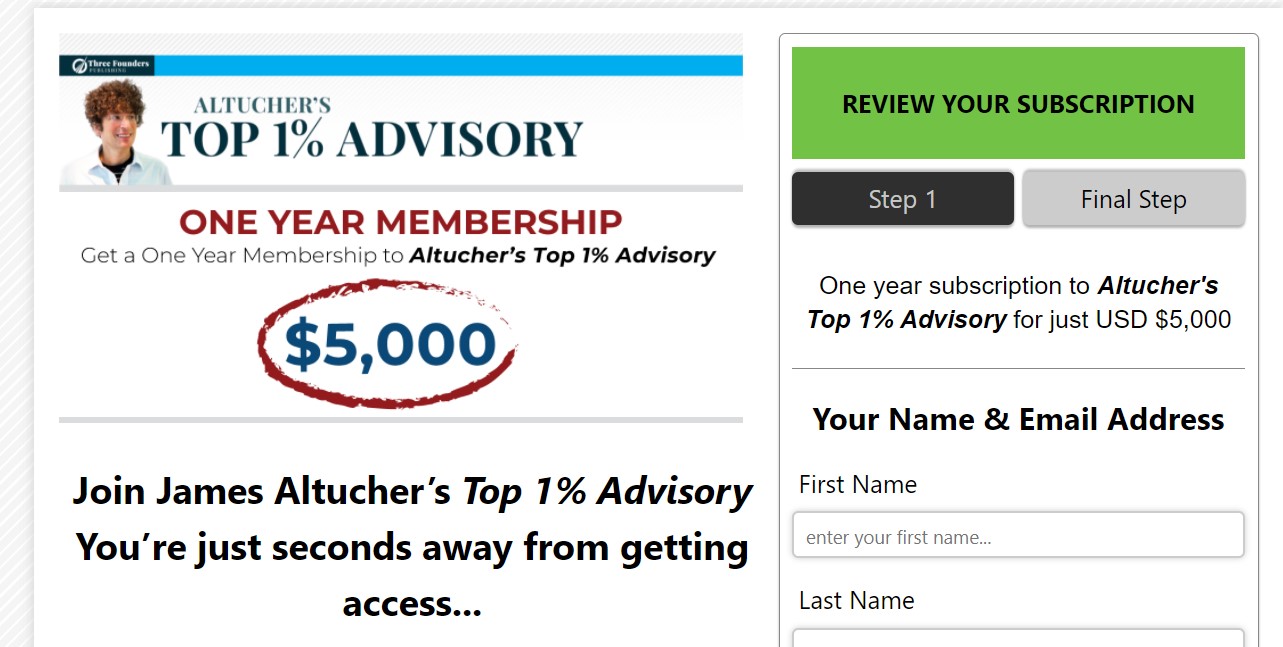

There's Going To Be A Million Upsells

The price of this newsletter isn't that terrible.

There's a deal out there where you can try it for $49 for the first year, and then it's $299 for every year after.

That's what a lot of other newsletters cost, so I'd say it's fair.

However, the reason the price is on the lower side is because there's a lot of upselling.

There are nine more newsletters and services on the Three Founders Publishing website, and some of them cost several thousand dollars a year.

For example, James has a newsletter that costs $5,000 per year.

You will definitely be marketed this product and all the other products constantly.

Additionally, since this is an Agora-owned company, you will be marketed in their other newsletters as well.

There's literally hundreds and possibly thousands of products they're going to try and sell you every single day.

Your email will be flooded with these offers.

It drives a lot of people insane.

There's a good refund policy.

This is probably the best thing about Altucher's Investment Network.

You get 90 days to test out this product to see if you like it.

If you're not satisfied (or lose tons of money on one of Jame's bad picks), you can get a full refund.

This is an excellent refund policy.

Recommended: The Best Place To Get High Return Stock Ideas

Altucher's Investment Network Pros And Cons

Altucher's Investment Network Conclusion

Some people will look at James Altucher and call him eccentric, quirky, or something like that.

While this may be true to a degree, I personally think he's kind of a sociopath.

James can lose millions of dollars or sell his possessions to live out of a suitcase on a whim.

This wouldn't be such a horrible trait if he weren't guiding others on stocks.

I mean, do you really want this man to advise your portfolio?

Sure, he's up millions at the end of the day, but that's mostly from his businesses.

He's created several multi-million-dollar companies, and I'm sure his newsletters bring in millions.

He can offset big stock losses with this.

Can you?

Are you comfortable taking one of his stock picks and losing 70% by the time you wake up?

I'm not, and James doesn't seem too concerned about it either.

No matter how big his failures are, he comes back with the same attitude and makes the same grandiose predictions.

His marketing simply doesn't change, no matter what happens.

Again, she seems a little sociopathic to me.

Here's A Better Opportunity

I'd pass on Altucher's Investment Network.

The good news is that there's a much better newsletter to get good stock ideas.

I've reviewed all the best.

To see my favorite place to get high-return stick picks (that's very affordable), click below:

Get High Return Stock Ideas!

See where I get my winning stock ideas below: